The Budget Debate Begins

The 2009 budget discussion began when Governor Pawlenty released his budget proposal in late January. The Governor’s task was not an easy one. The nation’s economy has been in a recession since December 2007. And the effects have been felt in Minnesota. Last November, 40 percent of poll respondents reported that their personal financial situation had gotten worse in the previous six months.[1] In these current economic times, any average family may find themselves unexpectedly needing help obtaining food, health care, child care, housing, job training or care for their aging parents.

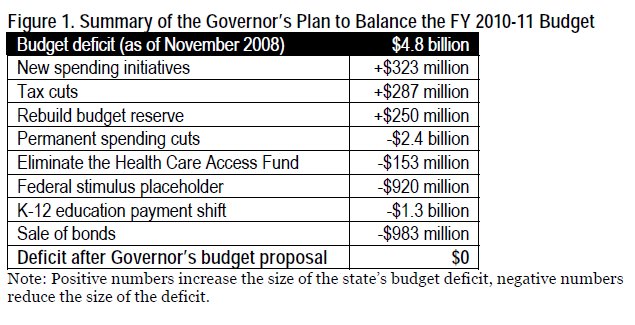

Just as the deteriorating economy has increased the need for many state services, it has also had a negative impact on the state’s finances. Based on the state’s November forecast, the Governor needed to solve a $4.8 billion deficit for the FY 2010-11 biennium ($5.5 billion when including inflation) and make progress in reducing the $4.5 billion deficit predicted for the FY 2012-13 biennium.

As Minnesota faces the highest rates of unemployment rates in nearly 25 years, it is not surprising that the Governor cited job creation as his highest priority within his budget. Yet the Governor’s budget proposal includes few direct measures that will improve the state’s job climate. Instead, the Governor proposes spending reductions that take money out of the state’s economy, jeopardize jobs and make it more difficult for families to survive the recession.

This report takes a close look at the Governor’s budget proposal, highlighting the major components and providing a deeper look at proposed spending reductions.

The Governor’s proposal contains two major components that would actually increase the state’s budget deficit by $610 million.

- $287 million in tax cuts, almost all of which would go to businesses as part of his “Minnesota Jobs Recovery Act.” The administration hopes the tax benefits will encourage businesses to create new jobs, though acknowledging that they will not produce short-term results.

- $323 million in new spending initiatives, with about half the increases directed towards K-12 education.

The state’s budget deficit is large and, more significantly, persistent. Unlike in years past, there is no quick economic recovery expected that will help lift Minnesota out of its current financial troubles. The state’s last economic forecast predicted a $4.8 billion deficit for the FY 2010-11 biennium and $4.6 billion for the FY 2012-13 biennium, and that is before considering the impact of inflation on the purchasing power of those dollars. Including inflation increases the size of the projected deficits to $5.5 billion and $6.1 billion, respectively.

Recently, the state’s Budget Trends Study Commission, made up of economists and former state commissioners, recommended that policymakers should balance the state’s budget not just in the upcoming biennium, but also in the following biennium. This is a challenging task, but would help to smooth some of the volatility we have been experiencing in the state’s finances.

While the Governor does include proposals that would help to reduce the deficit over the long-term, he also includes two significant proposals that would only provide a one-time fix for the state’s budget problems. The Governor’s budget proposal:

- Uses a budget gimmick that saves close to $1.3 billion in the FY 2010-11 biennium by shifting when the state makes aid payments to schools. Currently, the state pays schools 90 percent of aid in the current year and then follows up with 10 percent in the next year, once expenses have been finalized. The Governor proposes paying schools only 80 percent in the current year, shifting more than a billion dollars in spending to the FY 2012-13 biennium.

- Raises $980 million by selling bonds the state would repay using future tobacco settlement payments. Instead of paying for capital projects, as bonds usually do, the funds raised from this bond sale would be used to cover the debt service on bonds sold in previous years.

When the Governor released his budget in late January, Congress was still in the midst of putting together an economic recovery package. The Governor’s budget proposal conservatively estimated the state would receive $920 million from the federal government.

Now that the American Recovery and Reinvestment Act of 2009 is law, Minnesota is anticipating around $4 billion in federal funds, a portion of which can be used to resolve the state’s budget deficit. These resources are insufficient to fix the state’s entire budget problem, they are temporary and they come with strings attached, but they may still help soften some proposed spending reductions.

The single largest element of the Governor’s budget proposal includes $2.4 billion in permanent spending reductions. These proposed cuts touch nearly every area of the state budget, with the notable exceptions of K-12 education, public safety and corrections. With the state facing a deficit equal to 13 percent of the general fund, significant spending cuts will be a necessary part of the solution. However, the Governor’s proposal targets for cuts many services that support Minnesotans struggling through this recession.

This rest of this analysis examines the Governor’s budget in greater detail, focusing on proposals that would have the greatest impact on low- and moderate-income Minnesotans and other vulnerable populations.

Health and Human Services

During an economic downturn, the need for temporary public assistance to help stabilize struggling families increases. Employers cut back on health benefits, forcing the cost onto workers even as workers see their paychecks shrink. Under-employed families turn to food shelves to help make ends meet. Unemployed Minnesotans may find themselves temporarily on the state’s welfare-to-work program as they try to get back on their feet.

The economic activity that state spending generates is particularly important in this economic downturn. For example, the health care industry spends billions of dollars within our borders, with hundreds of thousands of Minnesotans employed in the public, private and nonprofit health care sectors. These jobs are supported, in part, by state and federal spending on health care.

The Governor proposes $1.4 billion in reductions to health and human services, including cuts impacting the general fund, the Health Care Access Fund (HCAF) and Temporary Assistance for Needy Families (TANF) funds. Health and human services accounts for 31 percent of the state’s general fund budget, but proposals in this area account for more than half of the Governor’s spending reductions.

The majority of the Governor’s proposed budget cuts would impact the state’s public health programs. The Governor proposes $1.1 billion in cuts to health care, resulting in more than 113,000 Minnesotans losing access to public health care in FY 2011.

The Governor’s proposal eliminates all access to public health insurance for almost all adults without children – over 65,000 people would lose access. The only childless adults who would still be covered under public programs are the elderly, people with disabilities, and a small group of people in extreme poverty (below 75 percent of federal poverty guidelines).[2] For everyone else, the only alternative would be private market insurance, although the cost of such insurance or the existence of any preexisting conditions would make this an unlikely option.

The Governor’s proposal takes all parents off of MinnesotaCare, the state’s subsidized health insurance program for low- and moderate-income working families. The Governor also reduces asset limits for Medical Assistance making it more difficult for parents to qualify and eliminates outreach efforts to get eligible parents enrolled in public programs. The result: close to 22,000 parents would lose access to public health insurance in FY 2011. After July 1, 2011, Medical Assistance would be the only option for parents, but they would need to have income less than 100 percent of federal poverty guidelines, have a child under age 19 and have less than $3,000 in assets for a single parent ($6,000 if there are two parents). Working parents with income above the poverty line, but without access to employer-sponsored insurance, would have to turn to cost-prohibitive private market insurance.

For the few adults who would still remain eligible for public programs (including childless adults), the Governor would eliminate coverage for the following services: dental (except emergency), chiropractic, podiatry, occupational therapy, speech-language therapy, physical therapy and audiology services.

The Governor’s budget proposal would result in more than 26,000 children losing access to public health insurance in FY 2011. The Governor’s proposals to eliminate outreach programs, repeal enrollment reforms and stop premium reductions would increase barriers to getting children insured.

The Governor also proposes to repeal a reform that helps children transition seamlessly from Medical Assistance to MinnesotaCare as family income increases, negatively impacting more than 13,000 children. Another 7,000 children would drop from health care programs because their parents would no longer be eligible for MinnesotaCare – research shows parents are less likely to enroll their children if they lose access themselves.

Minnesotans with disabilities rely on a variety of services that allow them to lead a full life and/or avoid institutionalization. The Governor’s budget proposal would significantly limit these options for thousands of people. The proposal would make several modifications to Personal Care Assistance (PCA), which provides more than 18,000 Minnesotans with disabilities with in-home assistance. The changes include increasing the level of disability required in order to qualify for receiving services, reducing the hours available for some recipients, restricting the use of PCA services, and instituting some provider standards, all for a state savings of $45 million in FY 2010-11 (the loss in resources reaches $85 million when lost federal matching funds are included). As a result, thousands of individuals who need assistance to manage the basics of life – such as dressing and feeding themselves – would lose access to PCA services.

The Governor also proposes limiting the growth in the number of slots for waiver services for persons with disabilities. These waivers – including Community Alternatives for Disabled Individuals (CADI), Developmental Disabilities (DD) and Traumatic Brain Injury (TBI) – allow people to access home-based Medicaid services instead of being moved into a more expensive and confining institutionalized setting. These waiver programs have been cut, limited or frozen since 2002, forcing thousands onto waiting lists. These lists would continue to grow under the Governor’s budget.

The elderly and persons with disabilities living in a group residential housing situation would be negatively impacted by a reduction in their personal needs allowance. These are funds residents are allowed to use for discretionary spending, such as purchasing clothing. Some individuals would have their monthly allowance reduced by 12 percent, others by 26 percent.

The state’s welfare to work program, the Minnesota Family Investment Program (MFIP) employs a number of strategies to raise people out of poverty, including limited education and training, counseling, job search assistance and child care assistance. The most common reason families in Minnesota apply for cash assistance is a job loss, a growing concern in today’s declining economy.

The Governor’s budget proposals would undermine already vulnerable Minnesotans by:

- Cutting assistance to families with disabled parents or children. Families on MFIP who have at least one disabled person in their household who qualifies for Supplemental Security Income (SSI) would see their MFIP cash grant reduced by $125 per month. This would impact approximately 7,000 families – most of these families are headed by disabled parents unable to replace the lost assistance with earnings.

- Providing less support to parents who leave welfare for low-wage jobs. The Governor’s budget proposal reduces the income at which families leave MFIP from 115 percent of federal poverty guidelines (FPG) to 110 percent of FPG. The Governor also reduces the Work Bonus for families who have left MFIP for low-wage work from $75 per month to $50 per month. This not only makes it more challenging for families to pay for essential needs on very low wages, but also jeopardizes Minnesota’s chances of reaching federal performance targets, which would result in the loss of federal funds.

- Making it much more difficult for parents to pursue education or training. Under the Governor’s proposal, MFIP parents are required to be employed at least 20 hours per week in order to pursue post-secondary education, this at a time when there are nearly three unemployed workers for every job vacancy.[3]

- Cutting assistance to families who have found affordable housing. Families who receive a housing subsidy would see their MFIP cash grant reduced by up to $100 per month (under current law, the grant is reduced by up to $50 per month). This would force public housing programs to increase rent subsidies for those families, limiting their ability to reach the thousands of families currently on waiting lists for affordable housing.

- Eliminating the Integrated Services Projects pilot project to implement a multidisciplinary approach to serve the most challenged families on MFIP.

- Cutting the funding that counties use to help families avoid homelessness by reducing funding for emergency assistance and other services for unemployed families.

On the surface, most of these proposed cuts do not help reduce the state’s general fund deficit because they create savings in the Temporary Assistance for Need Families (TANF) fund, the federal block grant to the state that pays for MFIP. However, the Governor “refinances” the freed up TANF funds in order to achieve savings in the general fund instead. In total, the Governor would refinance $34 million in resources that could otherwise be used to help low-income families struggling through the current recession.

For most families, access to quality, affordable child care is a key element of staying employed. Unfortunately, state general fund spending for child care assistance dropped by 26 percent between FY 2000 and FY 2009.[4] Thousands of families remain on the waiting list for child care assistance as state funding remains insufficient to meet the need. The Governor’s proposal adds further strain to the system, proposing a three percent reduction in the maximum rates paid to providers and a three percent increase in most parental copayments.

These increased copayments will make it more difficult for parents to afford child care. The rate decrease will also make it more challenging for child care providers to accept children using Child Care Assistance. Providers are likely to have no choice but to pass on the cost of the growing gap between the state’s reimbursement rate and their actual rate, essentially resulting in a second copayment increase for families.

The Governor proposes reductions in state funding for most other health and human service providers, including inpatient hospitals, mental health inpatient hospitals, basic care, transportation providers, pharmacies, nursing homes, disability services and other long-term care providers

One of the Governor’s major proposals is to merge the HCAF into the state’s general fund. The fund largely pays for MinnesotaCare. Created in 1992, the HCAF is funded through health care provider taxes and premiums paid by MinnesotaCare enrollees. The proposal to direct more than $550 million in provider taxes and health care premiums straight into the general fund is extremely controversial, as the resources would no longer be dedicated to funding health care for working Minnesotans.

E-12 Education

The future health of our state’s economy hinges on the success of our early childhood through 12th grade school system, also known as E-12 education. Yet Minnesota has work to do to ensure all that children have the opportunity to learn and succeed. There are large racial and income disparities in educational achievement. Low-income children are twice as likely to not be ready for kindergarten compared to children from families with the highest incomes. Business leaders recognize that closing this gap is not only the right thing to do, but the smart thing to do: the Itasca Project, a group of about 40 Minnesota CEOs, asserts that reducing racial and income disparities is critical to preserving Minnesota’s strong economy and business competitiveness.[5]

Yet schools across the state are simply in survival mode after years of budget austerity and cuts to programs and staff. Inflation-adjusted school district revenues have declined since 2003, as state funding for E-12 education has not kept up with inflation.[6] Meanwhile, dependence on local property taxes to fund education has increased substantially. Recently, the Rochester School Board closed their latest budget shortfall by eliminating 30 teaching positions and increasing class sizes from Kindergarten to grade 6.[7] The Anoka-Hennepin school district, which has a $15.8 million budget deficit, eliminated 130 teacher jobs and will cut down on textbook purchases, bus services and other expenses.[8]

E-12 education is one of the few areas under the Governor’s budget to receive an increase in resources. The additional funding, however, is focused on rewarding schools which are succeeding in making progress, rather than attempting to address serious educational disparities.

The most substantive recommendation from the Governor on E-12 education is to artificially lower the budget deficit for FY 2010-11 by delaying payment of $1.2 billion in state aid owed to school districts to the FY 2012-12 biennium. Policymakers agreed to a similar shift in state aid when Minnesota last faced significant budget deficits in 2003.

This could force some districts into drawing down their cash reserves or short-term borrowing (made more expensive by tight credit markets, as the Governor’s budget points out). This measure is a short-term fix for the state’s budget woes, which simply delays the deficit problem to the next biennium.

The Governor would expand the Q-Comp program to all school districts. The Q-Comp program is a 2005 initiative from the Governor that restructures teacher pay and professional development. Currently, less than a quarter of all school districts participate in Q-Comp. The Governor would require all school districts to participate. The expansion would cost the state more than $40 million in FY 2011 and $109 million in FY 2012-13. However, 35 percent of Q-Comp funding would come from an “optional” local levy, where the school district would be authorized to increase local property taxes to pay for a portion of Q-comp.

The Governor’s proposal includes an additional $91 million for schools that improve test scores as part of a new pay for performance plan. The program would reward charter schools and school districts that have increases in certain standardized test scores with more general education revenue.

While the Governor directs significant new resources to schools that are already having success, he directs very limited resources towards addressing the needs of struggling students. The Governor proposes $10 million for a new pilot program to set up an intensive summer school for 8th graders that are tested as not yet proficient in math or reading. This pilot program would reach 2,000 students in FY 2010 and 4,000 students in FY 2011 (there about 63,000 public school 8th graders in Minnesota).[9]

Affordable Housing

The housing market meltdown and the record number of foreclosures has put housing at the forefront of many policy discussions. After all, affordable and safe housing is a foundation for strong families and a healthy economy. Under the Governor’s proposal, however, the expiration of some one-time resources combined with additional budget cuts means that the state’s investment in affordable housing would fall by 25 percent from between FY 2008-09 and FY 2010-11.

The Governor’s budget proposal keeps his commitment to fully fund his plan to end long-term homelessness by increasing funding for the Housing Trust Fund by $4 million. However, this increase is paid for by reducing funding for the Challenge Program, which funds grants and low-cost loans for the development of affordable housing opportunities. This redirection of funding, along with a significant cut to the base budget, results in a 44 percent cut in the Challenge Program from the FY 2010-11 base, or 69 percent from FY 2008-09 levels. The Governor’s reduction would result in an estimated 1,200 fewer rental units and 500 fewer owner-occupied units constructed.[10]

The Governor’s proposal drains the Disaster Relief Contingency Fund, which helps victims after natural disasters, of its reserve dollars – $1.5 million in all – and uses the funds for rental assistance for families living in shelters. Staff from Minnesota Housing supported this proposal, explaining that there has been a large increase in children in shelters, and the money should be shifted to address the greatest need.[11]

Finally, state funding is mostly preserved for housing and supportive service programs that serve the most vulnerable, including people with mental illness.

Workforce Development

As Minnesota’s unemployment rate nears a 25 year high, the Governor announced in January that enhancing Minnesota’s job climate was his top priority. His budget proposal relies almost entirely on business tax incentives to generate new jobs (see the Tax and Aids to Local Government section of this analysis). While attempting to encourage job creation through the tax code, the Governor’s budget reduces funding for employment assistance and job training programs. The Governor’s budget proposal cuts general fund spending for the Department of Employment and Economic Development by 10 percent or nearly $9 million for the FY 2010-11 biennium.

The Governor would use $6 million from the Workforce Development Fund to hire new re-employment specialists who would be placed at Work Force centers to assist job seekers who don’t qualify for existing state and federal re-employment programs. However, this is not a new infusion of resources. Instead, the proposal directs funds away from existing job skills training programs and instead uses the resources for more supportive services such as referring people to information and helping complete Unemployment Insurance applications.

The Governor also proposes reducing or eliminating a variety of grants and programs serving for vulnerable populations. His budget proposal:

- Reduces general fund support for the Minnesota Jobs Skills Partnership by one-third. This program partners with businesses and educational institutions to develop training programs that meet businesses’ current needs for employees.

- Reduces funding for services helping people with disabilities get job training and find work, including employment and interpreter services for the deaf.

- Reduces pass-through grants to nonprofits providing low-income, minority and other vulnerable populations with employment services, including Opportunities Industrialization Centers, WomenVenture, Metropolitan Economic Development Association and Lifetrack Resources.

- Significantly decreases funding to several youth programs that help with job training and placement. For example, the St. Paul and Minneapolis Summer Youth programs, which support job placement and mentoring for youth, would be cut 17 percent and 25 percent, respectively. Youthbuild, a program for low-income young people to work toward their GEDs or high school diplomas, learn job skills and serve their communities by building affordable housing, would be cut $150,000.

- Eliminates grants to the Minnesota Alliance of Boys and Girls Clubs, Rural Policy and Development Center, Entrepreneurs and Small Business Grants, and the Minnesota Inventors Congress.

Higher Education

An important element of success in today’s competitive job market is a person’s educational background. Many people take advantage of an economic downturn to return to school to increase their marketability. Higher education funding, however, has been under pressure in recent years. State general fund spending on higher education has dropped 16 percent from FY 2000 to FY 2009. During the same period of time, per full-time student funding dropped 28 percent. The result has been double-digit increases in tuition and a greater student debt load.[12]

Under the Governor’s proposal, out-of-pocket costs for higher education would likely increase, putting it out of reach for some Minnesotans. The Governor proposes a 10 percent cut to higher education funding, or about $313 million for FY 2010-11. Almost all of these proposed reductions ($297 million) are to the University of Minnesota system (U of M) and Minnesota State Colleges and Universities (MnSCU).

Although the Governor encourages the systems to institute a firm cap on tuition, increases seem inevitable. A spokeswoman for MnSCU said this level of budget reductions would require “eliminating about 1,000 full-time-equivalent staff positions, cutting about 800 full-time professor jobs, increasing tuition 22 percent, closing down a large university and a large college, or shutting down 10 small colleges.”[13]

The Governor’s proposal includes other cuts to higher education, including:

- A 10 percent cut in state funding for technology programs that support bandwidth for internet at campuses and allow higher education libraries to share books and electronic resources.

- Eliminating the Office of Higher Education component of state funding for postsecondary enrollment for high school students at the University of Minnesota and Minnesota State Colleges and Universities. This does not necessarily eliminate the program, but postsecondary institutions and the Department of Education would have to fill in the gap to prevent reductions.

- Eliminating funding for the TEACH program, which improves the quality of child care by providing scholarships for child care providers to obtain a degree in early education.

The Governor does not propose cuts to the state grant program. However, he does recommend reductions to other state financial aid programs. State work study, which currently funds 75 percent of the wages of 11,900 students at colleges and universities, would be cut by five percent over the FY 2010-11 budget biennium, as would postsecondary child care grants and scholarships for low-income American Indian students.

Public Safety

The Governor cites “protecting state public safety programs” as one of his top budget priorities. As a result, there are no significant budget cuts to the Department of Corrections and Department of Public Safety operations. Instead, the Governor proposes increased funding for Corrections and the Minnesota Sex Offender Program (located within the Department of Human Services) to cover deficiencies in their budgets. However, he partially offsets this increased spending by proposing controversial reductions to pension benefits for some Corrections and DHS employees.

On the positive side, the Governor does not propose any budget reductions to Office of Justice programs, which serve victims of crime and domestic abuse.

The state’s court systems do not fare as well. The Governor proposes a five percent reduction to the state’s Supreme Court, Court of Appeals and Trial Courts, which would have significant impact on court services. The judicial branch estimates that it needs an additional $53 million for the FY 2010-11 biennium to preserve core functions. Instead, the Governor proposes $25 million in reductions.

One area of need within the Supreme Court is civil legal services, which provides legal assistance to Minnesota’s most vulnerable populations – low-income families, the elderly, people with disabilities and children. Currently, more than 20,000 people who are eligible for services are turned away each year due to lack of funding. Civil legal services received $2 million above base funding in one-time resources during the FY 2008-09 biennium. Under the Governor’s proposal, this one-time funding would not be renewed, plus civil legal services would likely receive an additional five percent reduction in its base budget – effectively a 12 percent reduction. As a result, funding for these services would fall below FY 2006 levels and an estimated 5,000 additional families would go without needed legal assistance.

The Board of Public Defense also receives a five percent reduction under the Governor’s proposal (nearly $7 million for FY 2010-11). The Board, however, requested a nearly $20 million increase for the biennium to maintain core services. Caseloads are already well above American Bar Association standards and the lack of public defenders is creating significant delays in the court system. The Board has already eliminated all non-mandated services, leaving few options for absorbing cuts without further reducing the number of public defenders.

The State Supreme Court Chief Justice Eric Magnuson has recently warned that a budget cut of five percent or more will force dramatic recommendations, including “shutting down conciliation court, cutting hours and suspending prosecution of 21 types of cases, including property damage, harassment, probate, and more than one million traffic and parking cases a year.”[14]

Taxes and Aids to Local Governments

The Governor’s tax proposal is made up of two main parts. First, there is a $272 million package of tax cuts for businesses. Second, there is $536 million in cuts, primarily in aids to local governments and various property tax credits.

Despite the fact that the state’s current budget deficit is largely the result of a downturn in revenues, the Governor’s budget does not contain any significant increases in revenues. Instead, the inclusion of the tax cut package means that the cuts to aids and credits only make a small dent in the state’s overall budget deficit. In fact, 51 percent of the cuts in this portion of the budget made in FY 2010-11 and 73 percent of the cuts made in FY 2012-13 pay for the new tax cuts, not for deficit reduction.

The Governor describes his tax cuts as an economic stimulus package. It includes:

- Gradually cutting the state’s corporate tax rate in half over six years. This is by far the largest of the tax cuts, costing the state $120 million in FY 2010-11, $410 million in FY 2012-13, and more in future years.

- Changing the sales tax exemption for capital purchases so that businesses will get the exemption at the time of purchase, rather than applying for a refund. This is the second largest provision in FY 2010-11, with a cost of $78 million. However, the cost drops to $23 million in the next biennium.

- A new Green JOBZ initiative that provides twelve years of tax incentives for companies that “create renewable energy, represent manufacturing equipment or services used in renewable energy, or that create a product or service that lessens energy use or emissions.”

- A few other credits for investments in small businesses.

This package of tax cuts would cost the state $272 million in lost revenues in FY 2010-11, and the impact grows substantially to $455 million in FY 2012-13. The ongoing cost is likely to be even higher, as some provisions don’t have any impact until five years in the future, and the corporate tax cut is not fully in effect for six years.

The administration argues that these tax cuts will provide incentives for growth. However, it is not clear how much “bang for the buck” the state will get in the near term. In an analysis of several options to stimulate the economy, economist Mark Zandi found that small business expensing provisions and cuts in the corporate tax were among the least effective of the options studied.[15] Given the large cost, especially of the corporate tax reduction, policymakers will have to consider whether the state can afford to gamble on whether such provisions will pay off.

The Governor’s budget includes deep cuts to the aids and credits portion of the tax budget, which includes aids to local governments, as well as the state’s Property Tax Refund, which provides refunds to Minnesotans whose property taxes are high in relation to their incomes.

There are cuts to four different ways the state provides aid to local governments in order to reduce property taxes and to ensure that even communities with low property wealth can provide a basic level of services:

- County Program Aid, which provides general purpose aid to counties, is cut by $126 million in FY 2010-11 and $132 million in FY 2012-13. This is 27 percent cut compared to base funding.

- Local Government Aid, which provides similar state aid to cities, is cut by $246 million in FY 2010-11 and $259 million in FY 2012-13, a 23 percent cut compared to base.

- The Homestead Market Value Credit and Agricultural Market Value Credit, which are also paid by the state to lower local property taxes, are cut by 13 percent and 17 percent, respectively.

The cuts to local governments raise real questions about their ability to provide continued services. The Governor’s budget recognizes that some increase in local property taxes will likely result, and includes a line item of $25 million in FY 2010-11 and $41 million in the next biennium that represents the additional property tax refunds that the state will pay out and the reduced amount of income taxes that will be collected (because taxpayers can take their property taxes as a deduction on their income tax forms.)

The Governor’s budget also includes a 27 percent cut to the Renters’ Credit, which provides property tax refunds to nearly 274,000 low- and moderate-income households whose taxes are high in relation to their income. This provision is likely to have a detrimental impact on the economy, as it would mean $51 million fewer dollars circulating in the local economy.

The Governor also would eliminate the Political Contribution Refund, which provides a refund of $50 for individuals and $100 for married couples for contributions to political parities or candidates, and makes changes to a three other smaller aid programs.

What Happens Next?

The Governor’s January budget proposal is just the opening round in what will be a long legislative session. The state’s February Forecast will be released on March 3. Most experts expect that the new forecast will reveal yet another deficit in the budget for the current biennium and a larger deficit than previously predicted for the next biennium. The Governor will need to revise his proposal to reflect changes in the state’s economic picture.

The recent passage by Congress of the American Recovery and Reinvestment Act (the federal “stimulus” bill) will also have a significant impact on the state’s budget balancing decisions. The federal bill will provide Minnesota with around $4 billion in federal funds, a portion of which can be used to resolve the state’s budget deficit. However, the funds come with strings attached that will need to be taken into account as state policymakers negotiate balancing the budget.

By mid- to late-March, the Governor will release a supplemental budget proposal that will respond to the new deficit figures, as well as incorporate the funds available from federal stimulus bill.

The Governor's Unallotment Actions

The state’s November Forecast revealed that a $426 million deficit had opened up in the state’s budget for the current biennium (FY 2008-09). Minnesota’s constitution requires that the state’s budget be balanced by the end of each biennium, so the new deficit had to be addressed before June 30, 2009. Under circumstances such as this, the governor has two options: he can wait until the legislature convenes and give them an opportunity to pass legislation to balance the budget, or he can act on his own to unallot unspent funds to bring the state’s budget into balance.

The Governor’s authority under unallotment provides a much more limited set of choices than legislative budget activity. The only two tools available are use of the reserves and cutting spending. There are some additional guidelines:

- The Governor has to spend down the entire budget reserve before cutting spending.

- While the Governor needs to consult with the Legislative Advisory Commission (made up of the Senate Majority Leader, Speaker of the House, Senate Finance chair, House Ways & Means Chair and certain other committee chairs), the legislature does not have to approve the Governor’s unallotment actions.

- No programs are exempt from unallotment. The Governor probably cannot unallot funding for the legislature and judicial branch, but probably can cut appropriations to the constitutional officers (Governor, Lt. Governor, Secretary of State, State Auditor and Attorney General).

- It is not required that cuts be taken across the board.

- There is no limit on how much can be unalloted from any one program.

- The Governor can unallot a transfer from the general fund to another fund.

- The Governor can unallot from funds other than the general fund, but only to resolve a deficit in that other fund.

Governor Pawlenty was concerned that if policymakers waited too long to take action, there would be fewer options for addressing the deficit. In addition, most experts expect that an additional deficit will open up for the FY 2008-09 biennium when the February Forecast is released, making it even more difficult to close the deficit by the end of the biennium. Therefore, the Governor took action in late December to unallot $426 million.

The major components of this action included:

- $155 million from the state’s budget reserve. By law, before the governor can unallot from any programs and services, he must use up any resources remaining in the state’s budget reserves.

- $110 million from aids and credits to counties ($66 million) and cities ($44 million).

- $73 million from human services, including programs such as mental health grants, Medical Assistance waiver programs and housing grants.

- $40 million from the state’s colleges and universities ($20 million each for University of Minnesota and MnSCU).

- $4 million from the Minnesota Housing Finance Agency.

- The legislature offered to reduce its budget by $2.2 million.

- $40 million in unspecified savings from state agency operation budgets – about 10 percent of unspent funds.