When the Minnesota Legislature convened in January 2013, the state was facing a $1.1 billion budget shortfall projected for the FY 2014-15 biennium, continuing more than a decade-long trend of frequent budget deficits. The state was not raising sufficient revenues to pay for the state’s priorities and the tax system had become increasingly unfair.

Budget decisions made in the 2013 Legislative Session will dramatically change the direction of the state. By the time the Legislature adjourned on May 20, policymakers had agreed to a budget that addresses the budget shortfall, makes the tax system fairer and invests in Minnesota’s economic success.

The turnaround was possible because Governor Dayton, the House and Senate shared the same priorities. They agreed Minnesota needed new revenues in order to erase the budget deficit and make critical investments in the state’s future. They also agreed that it was important to make the tax system more fair by narrowing the gap between the share of income that most Minnesotans pay in taxes and the smaller share paid by the highest-income Minnesotans. While there were differences in the details of how to achieve those priorities, policymakers were able to agree on a budget that shares the responsibility for funding public services more equitably, puts the state on a firmer financial footing and invests in the building blocks of shared economic success.

The final budget increases the income tax on high-income Minnesotans, ends preferences in the corporate tax and raises tobacco taxes, while also reducing property tax pressures through increased property tax refunds and more funding for aids to local governments. It closes the budget deficit and allows Minnesota to make overdue investments in our schools, health care, affordable college education, job creation and other public services that are crucial for a strong future.

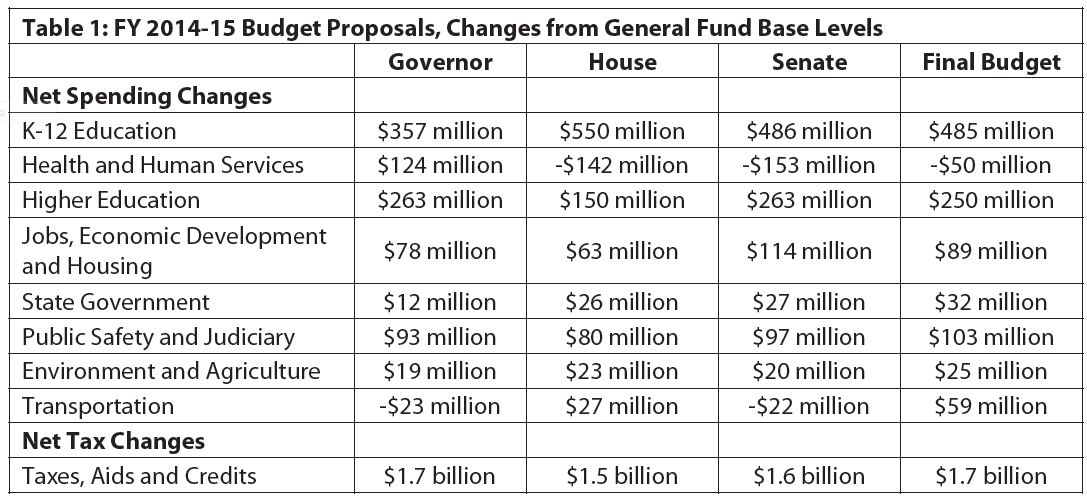

This analysis examines the details of the budget agreed to by Governor Dayton, the House and Senate, focusing on areas of major new investments and changes that will impact low-income and vulnerable Minnesotans.[1] Table 1 summarizes the differences between Governor Dayton’s budget proposal, House and Senate targets, and the final budget passed at the end of session.

Health and Human Services Takes Strides Forward Despite Overall Cut in Funding

Many essential services that help maintain and improve the health and stability of Minnesota families are funded through the health and human services area of the state budget. This was one area where Governor Dayton and the Legislature diverged in their priorities. Governor Dayton’s budget proposal increased health and human services funding by $124 million in FY 2014-15, just a small increase in the context of the $11.4 billion health and human services general fund budget. The House and Senate, however, both proposed to cut spending – $142 million in the House and $153 million in the Senate. Ultimately, the final budget included a $50 million cut in general fund spending in FY 2014-15.

The key to cutting overall funding for health and human services while protecting vital services is to turn to other sources of revenue. The most significant savings come from funding $403 million of Medical Assistance health care expenses from the Health Care Access Fund (HCAF), instead of the general fund. The final budget also raises $76 million in FY 2014-15 by reforming surcharge payments made by hospitals and HMOs. The budget also saves $25 million by reducing allowed administrative expenses for managed care organizations and raises $5 million by increasing the surcharge on Intermediate Care Facilities for the Developmentally Disabled (ICF/DD).

Instead of making deep cuts in health and human services, as had happened repeatedly in response to past budget deficits, policymakers used these resources to make important investments.

During the 2013 Legislative Session, policymakers took action to allow more than 100,000 low-income Minnesotans to gain access to more affordable and comprehensive health insurance through Medical Assistance. In mid-February, Governor Dayton signed a bill taking the first step to expand eligibility for parents, young adults and adults without children.[2] The final budget includes an additional $270 million in FY 2014-15 general fund spending to provide better access to health insurance for children and pregnant women and remove barriers to enrollment.

For the past 20 years, MinnesotaCare has enabled hundreds of thousands of working Minnesotans to purchase affordable health insurance for themselves and their families. The final budget preserves MinnesotaCare for most participants, taking advantage of federal funding to continue health insurance coverage for parents, young adults and adults without children with incomes between 138 percent and 200 percent of the federal poverty line (between $15,856 and $22,980 for an individual). The bill will also improve MinnesotaCare by reducing premiums and out-of-pocket costs for participants.

Earlier in the session, Governor Dayton signed a bill to create MNsure, a new health insurance exchange where more than one million Minnesotans will have the opportunity to find affordable health insurance that meets their needs.[3] MNsure is a web-based marketplace where individuals and small employers will be able to shop for, compare and purchase health insurance. Setting up this health insurance exchange is a critical step in implementing the federal Affordable Care Act in Minnesota.

The final budget makes other improvements to health care access. It:

- Continues to provide cancer and dialysis coverage through Emergency Medical Assistance and funds grants to help assist people who could be eligible for other health insurance options.

- Increases payments to many Medical Assistance health care providers, including dental providers.

- Helps families of children with disabilities by increasing funding for intensive services for children with autism and eliminating TEFRA fees for families with incomes below 275 percent of the federal poverty line ($64,763 for a family of four).

- Provides $15 million for Medical Education Research Costs (MERC) to help meet the need for more health care professionals.

Thousands of children will have access to better mental health care thanks to investments in more school-linked mental health services, improving the coordination of care for children with complex conditions, and helping family members learn skills so they can support their child’s treatment. There are also additional investments in mental health services for all ages, including funding additional mobile mental health teams to respond to crises, helping Minnesotans with mental health issues make the transition from institutional care back into the community, and expanding suicide prevention services.

The final budget gives parents needed flexibility to deal with family schedules without jeopardizing their child care assistance. It increases the number of excused absent days for families using child care assistance from 10 to 25, and allows additional excused days for children with medical conditions, but delays the implementation of this provision. The budget also includes $19 million to fund Governor Dayton’s proposal to improve access to high-quality child care providers by improving payment rates. Unfortunately, $5 million in unspent child care assistance funds that could have been used to help the more than 6,000 working families currently on the waiting list for affordable child care are instead redirected to the general fund.

Other health and human services highlights in the budget include:

- Repealing the family cap in the Minnesota Family Investment Program that prevents families from receiving additional assistance when another child is born, starting on January 1, 2015.

- Reinstating $500,000 in state funding for FAIM, or Family Assets for Independence in Minnesota, which matches savings by low-income participants for post-secondary education, purchasing a home, or starting a business.

- Increasing funding by $35 million for the Statewide Health Improvement Program (SHIP), which supports local efforts to improve community health through prevention.

- Increasing funding for food shelves.

- Increasing payment rates for all nursing facilities and home and community-based services, with additional funds for providers that achieve certain quality measures. The bill also cancels a scheduled 1.67 percent rate reduction for long-term care providers.

- Increasing funding to support youth facing challenging circumstances, including $4 million for runaway youth, homeless youth and youth at risk of homelessness; and another $1 million for youth who have been the victims of sexual exploitation.

- Providing additional resources to address homelessness, including funding for supportive services, transitional housing programs, emergency services and outreach grants.

E-12 Education Investments Will Increase Opportunities for All Children

Minnesota has a tradition of making education a top priority, recognizing that a well-educated workforce gives our state a competitive advantage in attracting high-quality jobs. Unfortunately, significant achievement gaps persist between white children and students of color. Making sure all of Minnesota’s children get a solid education is a key to the state’s future success.

Governor Dayton originally proposed $357 million in additional resources for E-12 education in the FY 2014-15 biennium, including initiatives focused on ensuring all children, including children of color and those with greater needs, have the opportunity to succeed. The House and Senate also made education a top priority, proposing to increase funding by $550 million and $486 million respectively. The final budget includes $485 million in additional investments in our children in the FY 2014-15 biennium.

One of the most significant proposals in the final budget updates the primary funding formula for school districts and increases general education funding by $238 million in FY 2014-15. School districts that have difficulty raising revenue through local levies will get additional resources through equalization aid included in the tax bill.

The final budget also includes provisions to reduce the achievement gap between Minnesota’s white students and students of color by helping children start off on the right foot. The budget includes $134 million for optional all-day kindergarten for every school, reducing expenses considerably for parents and ensuring that more children enter 1st grade with the skills that will help them succeed in school. There is also $40 million for Early Learning Scholarships to help thousands of high-need children ages three to five to participate in early learning opportunities, including high-quality early childhood programs.

There are also provisions to support children as they progress through school, with investments in the Minnesota Math Corps to help elementary and middle school students meet state standards, Regional Centers of Excellence to help schools increase achievement rates, and the Minneapolis Urban League to help youth of color access educational and employment opportunities. The final budget also increases funding for special education by $40 million in FY 2014-15, although this is far less than the $127 million originally proposed by Governor Dayton.

Originally, the House had proposed to fully reverse school funding shifts in the FY 2014-15 biennium through a temporary income tax surcharge. The final budget directs that any positive balance at the end of FY 2013 will go to reversing the shifts, in addition to current law requirements to use positive balances in future forecasts. Policymakers have said that if it appears that these provisions will not be enough to fully repay the shifts by the end of the FY 2014-15 biennium, they will take additional action in the 2014 Legislative Session.

Additional Resources Will Make Higher Education More Affordable

Minnesota will need more workers with degrees and credentials over the next decade to keep the state’s economy competitive. Projections indicate that by 2018, 70 percent of jobs in the state will require a post-secondary education, so it is imperative to invest in our students and workers.[4]

Higher education was cut deeply as the state responded to past budget shortfalls, and tuition has grown dramatically as a result. Governor Dayton took the first step in reversing these trends by proposing to increase higher education funding by $263 million in FY 2014-15, a 10 percent increase from FY 2012-13. The House and Senate also proposed strong investments in their omnibus bills, $150 million and $263 million respectively. The final budget increases funding for higher education by $250 million in FY 2014-15.

Policymakers focused on improving financial aid for low- and middle-income students through the State Grant Program by investing an additional $47 million in FY 2014-15. The resources will be used to increase the amount of tuition, fees and living expenses that can be covered by financial aid and adjusts the share of tuition students and families are required to pay. Some of this financial aid is specifically targeted at Minnesota State Colleges and Universities (MnSCU) students.

The bill also enhances funding for an American Indian scholarship program to enable students currently on the waiting list to receive up to $4,000 in financial aid for undergraduate students and $6,000 for graduate students. Additionally, another provision funds a summer bridge program to help students successfully make the academic transition from high school to college.

The final agreement includes other provisions to make college and training more affordable, and improve the state’s public colleges and universities:

- MnSCU funding is increased by $102 million in the FY 2014-15 biennium, including $78 million to freeze undergraduate tuition at 2012-13 academic year levels for two years, and $17 million to retain quality faculty.

- University of Minnesota funding is increased by $77 million in the FY 2014-15 biennium, including $43 million to freeze undergraduate tuition at 2012-13 academic year levels for two years, and $36 million for a new research and innovation program called MnDRIVE to invest in emerging fields.

The final budget takes some important steps forward in making college affordable and building our future workforce. However, these increases still leave higher education funding barely above FY 2010-11 levels, with no increases to respond to inflation or enrollment growth.

Investments in Jobs and Housing Will Strengthen Minnesota's Economy

A healthy economy depends on a strong workforce. And a strong workforce needs education, specialized training and stable housing. The Governor’s economic development budget included $78 million to make investments in job creation and housing, while the House and Senate bills included $63 and $114 million, respectively. The final budget invests an additional $89 million in economic development and housing.

Governor Dayton proposed substantial investments in loans and grants to Minnesota businesses through the Minnesota Investment Fund and the Minnesota Job Creation Fund. The final agreement includes $54 million in additional funding for these programs over the next biennium with the goal of creating 12,500 to 15,000 new jobs in the state. There is also funding for a new grant to help an economically depressed area of the state with economic development and job creation.

There will be additional funding for business development and adult workforce training competitive grant programs, more resources for job training for at-risk youth, and additional funding to improve employment opportunities for individuals with mental and physical disabilities.

Also included is an Unemployment Insurance tax rate reduction for businesses, following the Governor’s budget recommendation. The reduction will mean a savings of $57 million for businesses while still keeping the unemployment insurance fund solvent.

Stable and affordable housing is also important for attracting and keeping a high-quality workforce. The final budget provides funding for several housing initiatives, including:

- Building affordable housing in areas with job growth but not enough housing for workers.

- Providing rental assistance to improve housing stability for individuals with mental illness and students who move frequently.

- Helping ex-offenders find housing as they return to the workforce.

- Preventing family homelessness.

- Rehabilitating homes and rental properties.

The final budget also increases the resources available to help low-income families weatherize their homes to improve energy efficiency and save on the cost of utilities.

Investments in Legal System, Veterans Keep Minnesota Strong

The final budget includes investments to help vulnerable Minnesotans in the legal system:

- $6 million for civil legal services and the Board of Public Defense to reduce caseloads and help several hundred low-income families get legal assistance.

- $3 million for Crime Victim Assistance grants to restore funding that was cut in FY 2010-11.

- $2 million for Youth Intervention Program grants to keep young people out of the justice system.

The budget also ensures that Minnesota veterans have access to better education and health benefits. It includes an expansion of the GI bill, helping bring unemployed veterans back into the workforce by allowing those who served before September 11, 2001, to receive education and training benefits. The budget also invests $5 million to update the Minnesota Department of Veterans Affairs’ technology infrastructure and improve access to health care for veterans.

Tax Changes Create More Adequate and Fair Tax System

The final budget changes the state’s mix of taxes so that Minnesota’s tax system is more based on taxpayers’ ability to pay. It also raises new revenues to address the state’s deficit without deep cuts to public services, and funds state priorities such as closing the achievement gap, making college more affordable and other investments in building a stronger future.

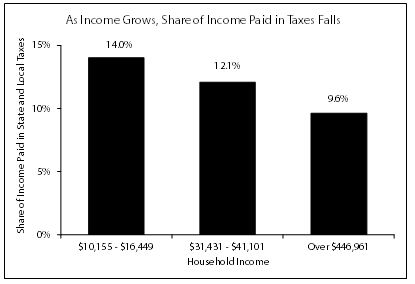

The budget makes significant progress toward resolving two serious problems with Minnesota’s tax system. The first problem is that the tax system does not raise enough revenue to meet the state’s needs, contributing to a cycle of frequent budget deficits. The second is that the responsibility for funding public services is not shared fairly. In fact, as household income grows, the share of income paid in state and local taxes falls. The wealthiest one percent of Minnesotans (those with household incomes over $446,961) pay 9.6 percent of their incomes in total state and local taxes. This is significantly less than the 12.1 percent paid by a moderate-income household making $31,431 to $41,101.[5]

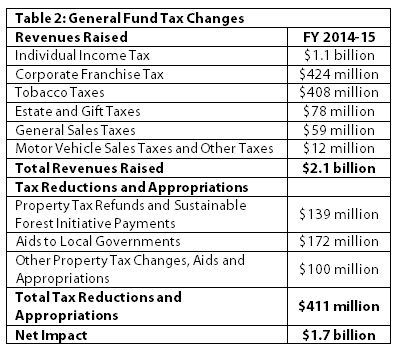

The major revenue-raising components of the tax plan are a new income tax bracket on the highest-income Minnesotans, ending some existing corporate tax preferences and an increase in tobacco taxes. The tax plan also includes significant additional funding for property tax refunds and aids to local governments.

The final budget creates a new income tax bracket on the highest-income Minnesotans, which raises $1.1 billion in the FY 2014-15 biennium. This “fourth tier” applies a 9.85 percent tax rate to taxable income above $250,000 for married filing joint filers, above $200,000 for heads of households and above $150,000 for single filers. Only the 2.1 percent of Minnesotans with the highest incomes will pay any additional income tax under this proposal. Around 20 percent of the increase in income taxes will be offset by lower federal income taxes, since taxpayers can deduct their state income taxes on their federal returns.[6]

This component of the tax plan is the most important in closing the gap between the share of income that the highest-income Minnesotans pay in state and local taxes and what average Minnesotans pay. Despite commonly raised fears, other states with similar proposals find they have little impact on the number of wealthy individuals in their states.[7] The fourth tier also will not raise taxes for most Minnesotans with “pass-through” income on their individual income taxes – a group often described as “small business owners.” Only 6 percent of tax returns with positive pass-through income will pay more under the new fourth tier.[8]

The budget also raises $78 million in FY 2014-15 through updates to the estate tax, and by using a gift tax to back up the estate tax.[9] The personal income tax and the estate tax are Minnesota’s only progressive taxes, meaning they increase as incomes rise.

Over time, Minnesota has come to rely more on local property taxes, which are based on home value and not as closely linked to someone’s ability to pay. This is one contributing factor to the rising regressivity of the tax system. The final budget pushes back on this trend through $411 million in additional funding for property tax refunds and aids to local governments.

The final budget includes over $15 million in FY 2015 in improvements to the Renters’ Credit, which provides property tax refunds to low- and moderate-income renters whose property taxes are high in relation to their incomes. The Renters’ Credit is effective in reducing the regressivity of rental property taxes, but it has been eroded in recent years, particularly by a 13 percent cut passed in 2011. More than 79,000 currently eligible Minnesota households will benefit from an average $152 increase in their Renters’ Credits, and approximately 30,000 additional households will become eligible.[10] This is an important provision to ensure that these low- and moderate-income Minnesotans don’t pay too high a share of their incomes in property taxes.

Property tax refunds for homeowners will increase by $120 million in FY 2015. About 309,300 households will see an average $221 increase in their property tax refunds, and another 112,000 households will now qualify.[11] A significant number of homeowners do not apply for their property tax refunds. In order to increase participation, the budget includes a one-time effort in 2014 to reach out to homeowners who may be eligible for a property tax refund of at least $1,000 but have not applied.

In addition, the final budget includes $400,000 for taxpayer assistance grants to help meet the current demand for free tax preparation services for Minnesotans who are low-income, elderly, disabled or limited English speakers. These services help Minnesotans get the tax refunds for which they qualify, but also ensure that tax returns are done accurately.

Cuts in state funding to cities and counties over the years have created pressure on local property taxes. The final budget seeks to reverse this trend through increasing funding for Local Government Aid to cities by $80 million, County Program Aid by $40 million, and $10 million in aids to townships in FY 2015. Cities and counties will also benefit from a new sales tax exemption on their purchases. To emphasize that legislators intend these actions to keep down property taxes, the tax bill limits how much property taxes most cities and counties can collect in 2014.[12] The budget also includes $86 million in FY 2015 for changes in education finance, primarily by increasing equalization of school district operating referendum levies.

The final budget increases cigarette taxes by $1.60 per pack, and makes related changes to taxes on other tobacco products. This was the level proposed by the House omnibus tax bill, and is higher than the 94 cents originally supported by Governor Dayton and the Senate. Tobacco taxes are the state’s most regressive taxes, but an increase is supported by policymakers because it can reduce state health care costs in the long term by providing a powerful deterrent against youth smoking and a motivation for smokers to quit. In total, tobacco tax changes raise $408 million in FY 2014-15.[13]

The final budget ends several preferences in the corporate franchise tax. These include changes in provisions relating to corporations with overseas income, such as repealing the Foreign Royalty subtraction, which exempts royalty payments a multinational corporation receives from its foreign subsidiaries; and repealing Foreign Operating Corporations (FOCs), which provides a tax benefit for parts of multinational corporations that are incorporated in the U.S. but receive substantial income from foreign sources. The bill will no longer allow individuals and corporations to receive a Research & Development Credit that exceeds their tax liability, and adjusts minimum fees paid by corporations, partnerships and S-Corps for the first time since 1990. In total, the corporate tax provisions raise $424 million in FY 2014-15.

While there was some discussion this session of expanding the state’s sales tax to a broader set of goods and services and lowering the sales tax rate, the sales tax portion of the omnibus tax bill contains a relatively small set of changes. Combined, all sales tax changes raise $59 million in FY 2014-15.

The tax bill includes three provisions to modernize the sales tax and create a more level playing field among retailers, including:

- Requiring some internet retailers to collect sales taxes from Minnesota residents, just as retailers physically located in the state do. This “affiliate nexus” provision raises $10 million in FY 2014-15 by requiring remote retailers who sell their products to Minnesotans through referrals from businesses with a physical presence in Minnesota to collect the sales tax. Currently, sales taxes are due on these purchases, but the responsibility for remitting that tax falls to the consumer.

- Taxing some digital goods, such as e-books, music and movies.

- Taxing all paid television services the same, replacing a current disparity between cable and other kinds of TV service delivery.

The final budget also applies the sales tax to business purchases of warehousing and storage; industrial and commercial equipment repair and maintenance; and telecommunications equipment.

These sales tax provisions pay for sales tax cuts, which include exempting cities and counties from paying the sales tax; providing an “upfront” sales tax exemption when businesses purchase capital equipment, replacing a refund process; and exempting purchases of construction materials for a number of economic development projects.

As policymakers sought to put together a tax package that best balanced the needs for revenues and to make the tax system fairer, some proposals that had been put forward during the session did not become part of the final legislation.

Unfortunately, the bill did not update the Minnesota Working Family Credit – the state’s version of the federal Earned Income Tax Credit – to conform with improvements in the federal EITC for married couples. This is an important strategy for making Minnesota’s taxes simpler and less regressive; policymakers would be wise to pass this provision next year when they consider federal conformity legislation.

There was also robust discussion in the legislative transportation committees about raising dedicated resources for transportation, including the state’s gas tax and an increase in metro-area sales taxes to fund transit. These provisions did not pass.

Shortfall Did Not Derail Long-Term Vision

Minnesota policymakers made important achievements during the 2013 Legislative Session that we have been calling for through more than a decade of deficits and deep spending reductions. In the face of a budget shortfall, policymakers stepped up to raise additional revenue, seizing the opportunity to address inequities in the tax system. Breaking the pattern of responding to deficits with budget gimmicks and deep cuts to higher education, health and human services, and economic development, policymakers instead raised new revenues that address the deficit and make investments in essential priorities that will support Minnesota’s future economic success. This session appears to mark the beginning of a new trend where a long-term vision for the state triumphs over short-term fixes.

By Caitlin Biegler, Nan Madden, and Christina Wessel