It's a bigger deal than usual, but doesn’t yet have all the answers

The

April Revenue and Economic Update is a first look at the economic and fiscal impacts of the coronavirus crisis in Minnesota. The quarterly report from Minnesota Management and Budget (MMB) shows that state revenues have dropped considerably and the national economy has likely fallen into recession.

While the Update doesn’t give us the full picture yet, we see every day the importance of pulling together to ensure all our neighbors can get the health care they need to keep themselves and their communities safe, and the supports that workers and families need to get by. It’s going to take some additional resources – including from the federal government – to make it through and set the groundwork for a stronger Minnesota.

Some of the top takeaways from the Update include:

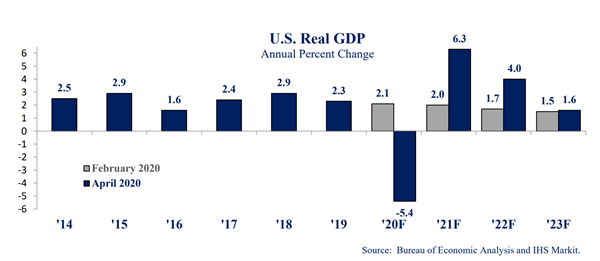

- The near-term economic picture is not good. The economic forecasters have dramatically changed their national GDP projections, replacing the 2.1 percent growth in 2020 predicted in February to a 5.4 percent contraction in the new Update. They predict growth to resume, with 6.3 percent growth expected in 2021. The state’s economist cautions, however, that doesn’t mean getting back to where we would be if not for the pandemic. These projections include the anticipated impact of the CARES Act and other measures already taken by Congress.

- State revenues are coming in below projections, but since there’s a lag in data, we’re not yet seeing the full force of the coronavirus’s impact. State revenues for February and March came in $103 million below projections; that’s 3.8 percent less than in the February 2020 Economic Forecast. The decline in revenues is primarily due to income tax revenues for those two months coming in 9 percent below projections, and we can expect revenues from income, sales, and corporate taxes to drop in the future.

- Unemployment is expected to rise. While the monthly unemployment numbers don’t yet reflect our country’s rapidly changing economic situation, the forecasters expect national unemployment to reach a high of 10.3 percent late this year. Since mid-March, nearly 440,000 Minnesotans have applied for unemployment insurance.

- Forecasters note that their projections “remain highly uncertain.” The forecasters assign only a 45 percent chance that their baseline forecast is correct and give a 35 percent chance for a more pessimistic scenario that includes an even deeper recession. They only assign a 20 percent probability to a more optimistic scenario with a faster economic recovery. They also note that there is a wide variation among forecasters in their current economic projections, so we should not be surprised if these estimates change over time.

This Update confirms that the fiscal impact of the public health pandemic is starting to hit the state budget. The situation with coronavirus is unprecedented and changing daily, and much of the impact isn’t yet showing up in the data. With many tax payments delayed to give breathing room for individuals, families, and businesses during this uncertain time, it’s harder for the state to predict its future revenues based on the data currently coming in. It will be a while before we see the full impact of the coronavirus and the measures taken to mitigate its spread.

Unlike the state’s economic and budget forecasts, the economic update does not include information on changes in expenditures. For example, it does not calculate the increased needs in our communities for things like health care and food assistance.

Because the situation has changed so much since the February Forecast was released, MMB announced they will produce a more comprehensive budget projection in early May to inform decisions through the remainder of the legislative session.

MMB recently made some rough calculations and found

a recession the size of the Great Recession would produce a $3 billion state revenue loss. Some preliminary indicators suggest the recession that coronavirus is bringing about could be worse.

Because states have to balance their budgets, they face the double whammy in an economic downturn that their revenues drop at the same time that more of their residents are needing some support to get by. Minnesota’s robust budget reserve will be an important tool to draw on during these tough times. The state will also need to shore up its revenue streams – and in the very near term, it should avoid losing revenues by

conforming to new federal tax breaks for business losses that occurred in years past.

Federal funding also plays an essential role in ensuring key public services can continue, and to prevent the further drag on the economy that would be caused by cuts in services or laying off teachers and other crucial public employees. While some action has been taken,

the federal government must act quickly to provide additional flexibility and funding to states, and blunt the impact of the coming recession.