Policymakers’ primary task in the upcoming legislative session will be to set a budget for the FY 2020-21 biennium, and today’s February Budget and Economic Forecast released by Minnesota Management and Budget gives an updated measurement of the economic context for those decisions. The forecast shows a $1.1 billion surplus for FY 2020-21 and an $11 million deficit for FY 2022-23.

The numbers from today are lower than what was shown in the November forecast. As we’ve noted before, the United States is in one of the longest economic expansions on record. But economic growth has shown signs of slowing down over the past year, and that’s now starting to cut into how much revenue the state can expect to bring in. What hasn’t changed is the importance of making tax and budget choices that continue building broader prosperity that includes all Minnesotans. (Keep reading to the end for our full take.)

The February forecast compares what the state would be expected to spend on schools, roads, and other public services to how much revenue the state would expect to bring in under existing laws and current economic projections. Some of the top data points from the February Forecast and their implications include:

- The forecast projects a $1.1 billion surplus for the upcoming FY 2020-21 biennium. This includes the positive balance for FY 2018-19.

- The forecast projects a slightly negative balance in the future. Today’s report shows an $11 million deficit for the FY 2022-23 biennium, which means projected revenues are expected to be just slightly lower than projected expenditures. However…

- …The future balances do not take into account what it takes to maintain current levels of state services. Keeping up with inflationary costs for Minnesota’s current commitments would cost an additional $1.1 billion in FY 2020-21 and $2.7 billion in FY 2022-23. In other words, today’s figures are built on the assumption of flat funding for most areas of the budget.

- The forecast shows the potential harm of letting the provider tax expire. By FY 2023, the Health Care Access Fund will have a deficit of over $900 million if the provider tax is allowed to expire. This fund primarily goes to affordable health care.

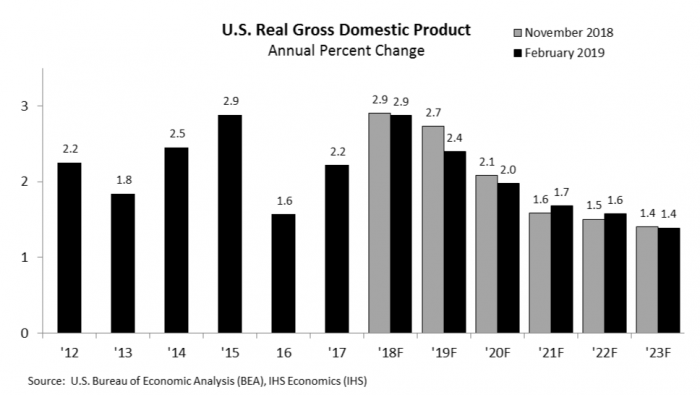

- The forecast expects weaker economic growth than projected in the November 2018 forecast. Every forecast includes a best guess at what the national economy will do over the next few years. Today’s report expects the economy to continue growing, but predicts more sluggish national GDP growth, slowing down substantially to 1.4 percent by 2023.

- There are a number of sources of uncertainty. Minnesota’s economic consultant, IHS Markit, assigns a 60 percent probability that their baseline economic forecast accurately predicts how the future economy will perform, a 25 percent probability to a more pessimistic scenario, and a 15 percent probability to a more optimistic scenario.

- This is one-time good news. The surplus is largely due to temporary, not ongoing, factors. The short-term economic boost from the 2017 federal tax bill will fade, global economic growth is expected to weaken, and a strong U.S. dollar reduces net exports.

Today’s budget numbers underscore the importance of maintaining and strengthening revenues that fund services that Minnesotans count on. Lower national economic growth will put a damper on future state revenues. In addition, Minnesota revenues continue to be eroded by large and growing cuts in the estate tax, tobacco taxes, and business property taxes that were passed in 2017.

Governor Tim Walz’s budget proposal released last week takes several steps toward ensuring the state has reliable funding for the services Minnesotans want and expect. His plan would repeal the scheduled expiration of the health care provider tax, protecting this critical source of funding for affordable health care options that reach more than one million Minnesotans. He also proposes increasing the gas tax – which has lost about one-third of its buying power since 2000 – to help address the state’s transportation needs. The gas tax increase also makes it possible to return certain sales tax revenues that are currently being diverted to transportation back into the General Fund, where they can be used for investments like quality education and health care.

Today’s forecast release is the start of the next phase in developing the state’s two-year budget. Walz will update his budget proposal to reflect these new forecast numbers and stay in balance, and the Minnesota House and Senate now have the numbers they use to start putting together their proposals for the FY 2020-21 budget.

The numbers may have changed, but what Minnesotans are counting on has not: sustainable revenues that fund quality education, health care, child care, roadways, and transit that reach every community across the state.

-Clark Goldenrod