Federal investments in family economic security – including stable housing, nutritious food, affordable health care, education and training, and boosting family incomes through tax credits, among other things – keep millions of families out of poverty and reduce the severity of poverty for millions more. But calls by some to cut these investments in the name of deficit reduction are off the mark. Aside from health care, federal spending in these areas is declining compared to the overall economy, according to a recent report from the Center on Budget and Policy Priorities.

Many supports for lower-income people and families are designed to grow when the economy is doing poorly and more Americans fall on tough times, and then shrink when the economy is doing well. The Center on Budget and Policy Priorities took a look at spending that supports family economic security, and found that during the Great Recession, federal spending on these services grew to meet the needs of more people who were struggling to find work and make ends meet.

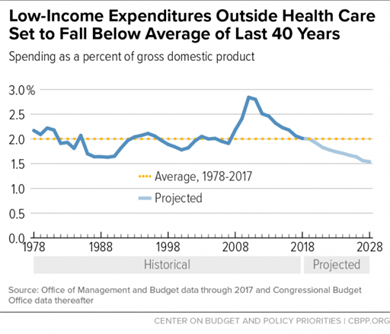

The spending bubble from the recession has disappeared. Compared to the economy as a whole, federal spending on nutritious food, stable housing, cash assistance, and more is shrinking.

The exception is health care, where growth reflects broader health care trends. Health care investments, such as in Medicaid, the Children’s Health Insurance Program, and others, allow kids, people with disabilities, and workers who don’t get health insurance through their job to see doctors and get medication they need to be healthy. While public health care costs are projected to continue to rise over the next 10 years, the increase will be slower than previous decades.

Since 2010, overall spending on investments in family security has been falling as a percentage of the economy. The increase in health care spending has been more than cancelled out by the decreased spending for other low-income supports. This year, federal spending on these investments, as a share of the economy, will be below what it was before the recession started, and almost equal to the 40-year average level of spending. Federal spending on investments in family security is projected to continue to fall over the next 10 years.

The proposed cuts to these investments, including in President Donald Trump’s budget and the recently approved House Budget Resolution, would create increased hardship and poverty across the nation. Their arguments that cuts to these investments is needed to address the growing federal deficit ignores the fact that federal investments in these areas are declining. Instead, what has contributed to the recent steep increase in the federal deficit is the federal tax bill passed late last year. Lawmakers failed to fully pay for the bill’s tax cuts, which went predominantly to profitable corporations and wealthy individuals and families. The resulting drop in revenues harms the nation’s ability to fund essential services and respond to future economic downturns. And cutting supports for struggling families isn’t going to fill the budget gap caused by the federal tax bill.

For many people, investments in economic security can make the difference between hunger and healthy meals, or between a roof over their heads or a life on the street. Blaming these important investments for the growing national debt has to stop.

-Sarah Orange