The state’s Minnesota Management and Budget released the February Budget and Economic Forecast today. Here are our top takeaways:

- The state’s budget situation is better than in the last forecast. The positive balances in each of the three budget cycles described in the forecast are higher than projected in November.

- A $743 million positive balance is projected for FY 2016-17. This figure is for the budget cycle that ends on June 30.

- Positive balances are also projected for the future. Today’s report shows a $1.7 billion positive balance available for the upcoming FY 2018-19 biennium. This figure includes the balance for FY 2016-17. This forecast also projects a $2.1 billion structural positive balance for FY 2020-21.

- But the future balances do not take into account what it takes to maintain current levels of service.When the impact of inflation on spending is included, the surplus figures morph into a much smaller $540 million surplus in FY 2018-19 and a $959 million deficit in FY 2020-21. This means that to the extent the surplus is used for additional spending or tax cuts, this will come at the expense of keeping up with current commitments.

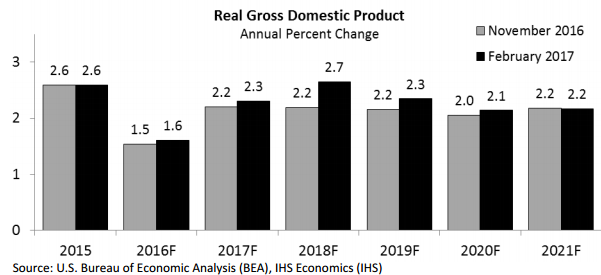

- The forecast expects higher economic growth than projected earlier. The national economy is now expected to grow at a higher 2.3 percent rate in 2017 and between 2.1 and 2.7 percent yearly growth from 2018 through 2021.

- For the most part, the forecast does not reflect the impact of likely federal policy changes. The economic forecast incorporates the projected effects on the national economy of likely reductions in individual and corporate taxes and increased spending on infrastructure. However, citing “considerable uncertainty,” the forecasters did not include any economic impact of federal decisions on trade, immigration or health care. And the projected state budget figures do not anticipate the impact of potential federal cuts to state funding, although major changes are being considered.

- The forecasters are moderately confident in these projections, but there’s more uncertainty than usual. IHS Markit, Minnesota’s economic consulting firm, assigns a 60 percent probability to their baseline economic forecast, and a 25 percent probability to their more pessimistic scenario in which there’s a short recession next year caused by “strained trade relations” and postponed investment by businesses. The forecasters assign a 15 percent probability to a more optimistic scenario.

The February forecast sets the stage for making budget and tax decisions for the upcoming FY 2018-19 budget cycle. Last month, Governor Mark Dayton kicked off the budget process with his budget proposal, which he will update the week of March 13. Now, legislators will use this forecast to construct their tax and budget proposals.

The positive forecast numbers create the opportunity to make targeted investments so that more Minnesotans can participate in the state’s economic growth, such as through expanding affordable health care, child care and targeted tax credits like the Working Family Credit for Minnesotans who are working hard but struggling to pay the bills.

But policymakers should also be cautious, because the landscape is likely to change significantly as federal policymakers are expected to enact large-scale changes over the next year. As required by law, the February forecast’s budgetary projections are based on current state and federal laws – they don’t anticipate likely federal changes.

Federal funding is a significant part of the state’s budget, and every area of the federal budget that touches the state is under consideration for sweeping changes or funding cuts. For example, President Donald Trump plans to cut non-defense discretionary spending – about a third of which goes to states and local governments to fund key priorities like education, affordable housing, and training and employment services – in order to increase defense spending by $54 billion in 2018.

One prominent theme to watch for is federal action to cut funding in areas of shared federal-state responsibility and shift more responsibility to the states, such as through substantial cuts to Medical Assistance that would grow over time as a result of turning Medicaid into a block grant or otherwise capping funding at inadequate levels.

This would come on top of the harm done through changes to the Affordable Care Act (ACA). While the details are still murky, analysis of past proposals to repeal the ACA predicts that the number of Minnesotans without health insurance would more than double, and Minnesota could lose more than $16 billion in federal funding over 10 years. Just cutting the enhanced federal matching rates for the ACA’s Medicaid expansion population, means the state would need to commit an additional $815 million in 2019 alone to continue this health coverage.

In addition, major restructuring of other federal safety net programs could increase pressure on the state to respond to the needs of Minnesota residents. At the same time, federal tax changes could erode the state’s ability to raise revenues.

With these large and as-yet undefined federal changes on the horizon, Minnesota policymakers should make their tax and budget decisions this year with an eye to maximizing the state’s ability to respond. They should particularly avoid making large tax cuts and especially tax cuts that grow over time, which would greatly compromise the state’s ability to provide health care and essential public services after significant reductions in federal funding. The state should also maintain a robust budget reserve to be sure we’re equipped to respond to future economic downturns, given that the kinds of support that the federal government has provided in past downturns may be less likely.

-Clark Biegler