The Minnesota Senate’s 2016 supplemental tax bill released this week includes provisions that would make strong strides toward more Minnesotans being able to reach economic security. Today’s blog looks at two of our priorities for the session that are included in this bill: expanding the Working Family Credit and the Tax Time Savings bill.

The Senate 2016 tax bill includes the provisions from Senate File 2586, authored by Senator Ann Rest, to expand the Working Family Tax Credit. Tax policy is often perceived as being primarily for the benefit of special interests, but this proposal, in contrast, makes everyday Minnesotans the priority. It provides targeted tax reductions to families and individuals working their way toward financial stability by:

- Increasing the size of the credit for most currently eligible households;

- Making some additional families and individuals eligible by increasing the incomes that they can earn and still qualify for the credit; and

- Reaching younger workers without dependent children by lowering the age requirement to qualify for the credit from 25 years old to 21.

In all, about 386,000 Minnesota households would benefit from the Working Family Credit expansion, receiving a total of $49 million in tax reductions in FY 2017.

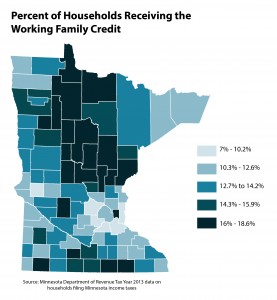

The families and individuals who currently receive the Working Family Credit are split almost equally between Greater Minnesota and the 7-county metro area. In some counties, primarily in Greater Minnesota, 16 percent or more of all households who file income taxes receive the credit. The credit is only available to households with earnings from work, and it offsets a portion of the significant state and local taxes that modest-income Minnesotans pay.

Governor Mark Dayton has also made the Working Family Credit a priority in his budget. The Working Family Credit is Minnesota’s version of the federal Earned Income Tax Credit (EITC). A strong and growing body of research on the EITC and similar tax credits finds they are successful in supporting parents’ work efforts, and that children in families receiving these credits are healthier, do better in school, and are more likely to attend college and earn more as adults.

Expanding the Working Family Credit can also help the state make progress on addressing racial disparities in economic well-being. About 30 percent of households eligible for the credit are people of color, and Voices for Racial Justice has included Working Family Credit expansion in their 2016 Racial Equity Agenda as one of their recommended policies to make Minnesota work for everyone.

The Senate tax bill also includes provisions so that Minnesotans receive the tax credits for which they qualify, and can use their tax refunds to build savings and build a stronger economic future. These provisions come from Senate File 2578 authored by Senator Lyle Koenen, and they provide additional funding for nonprofit organizations offering free tax preparation services (known by the acronym VITA) to serve more Minnesotans and to provide financial capability services at tax time, such as opening a savings account.

There is not a lot of time for the tax conference committee to do its work before the session ends on May 23. But these are two provisions that clearly deserve a place in the final tax bill.

-Nan Madden