A recent report measures the wide racial wealth gap in the United States, and points to public policy decisions that can play a big role in widening or shrinking this gap.

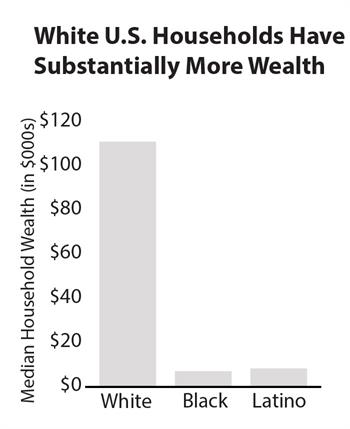

A report from Demos and the Institute for Assets & Social Policy, The Racial Wealth Gap: Why Policy Matters, shows that the median wealth of white households in the U.S. was over $110,000 in 2011, while the median wealth for black households was $7,113 and for Latino households was $8,348. The report shows that this gap is largely a result of policy choices made over time that have led to large disparities between whites and communities of color in educational achievement, incomes and homeownership rates, all of which are key elements for building wealth.

Wealth is more than just income: it’s the value of financial resources people have minus what they owe. Without adequate wealth, families can’t afford a college education and the opportunities for higher incomes and economic security that education offers, and they don’t have the financial cushion to weather job loss or a major illness without significant hardship.

This gap is bad for our economy, threatening economic stability and even future growth. With growing populations of color in Minnesota, our future economic success depends on everyone reaching their full potential in the state’s economy. Eliminating the racial wealth gap would substantially increase the wealth of black and Latino households. The report finds that if the nation:

- Eliminated disparities in homeownership, median black wealth would grow by $32,113 and median Latino wealth would grow by $29,213, narrowing the wealth gap between white households and black and Latino households by one-third.

- Eliminated disparities in income, median black wealth would grow by $11,488 and median Latino wealth would grow by $8,765.

- Eliminated disparities in college graduation rates, median black wealth would increase by $1,313 and median Latino wealth would increase by $3,528.

So how do we get there? Demos and the Institute for Assets & Social Policy include a number of policy suggestions to narrow racial gaps in wealth, including:

- Reducing gaps in K-12 education funding. Black and Latino students are more likely than white students to attend schools that are underfunded, have less experienced teachers and offer fewer advanced courses. That can leave these students without the tools they need to go to college and earn good wages, both important tools for building wealth.

- Increasing the minimum wage. As we’ve reported before, black and Latino workers are much more likely to earn lower wages, and therefore they benefit from increases in the minimum wage. A boost in their incomes would give black and Latino workers a better chance to build wealth.

- Limiting the mortgage interest deduction. Currently black and Latino households do not benefit as much as white households from the mortgage interest deduction. They typically own lower value homes, which generally means they do not receive as large of a mortgage interest deduction. Further limiting the mortgage interest deduction, which is currently available for interest paid on up to $1 million of mortgage debt, will help to narrow the difference between the value of the mortgage interest deductions that black and Latino households receive and what white households receive.

Policymakers and others will find many additional policies to close the racial wealth gap outlined in the report. In 2014, Minnesota policymakers passed a long overdue increase to the minimum wage, but more can be done so that all Minnesotans can build assets and wealth, no matter their race or ethnicity.

-Clark Biegler