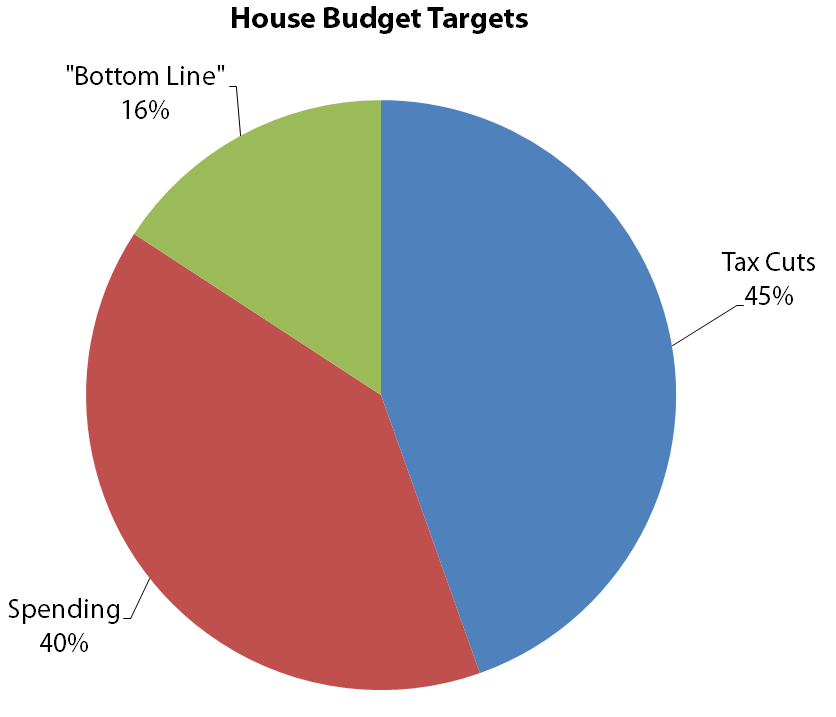

Priorities in the House budget targets released this afternoon include $550 million in tax cuts, $488 million in new spending, and $195 million on the “bottom line.”

Taxes: $502 million of the House’s proposed tax cuts have already been passed as House File 1777, which includes two primary components:

- Federal conformity items, including an improvement to the Working Family Credit for married filers, addressing the ‘marriage penalty’ faced by non-itemizers and several other items.

- ‘B2B repeal,’ or the elimination of three business-related sales taxes.

That leaves about $48 million to be dedicated to property tax reductions for homeowners, renters and farmers.

It is still the case that low- and moderate-income Minnesotans pay a higher percentage of their incomes in state and local taxes than the highest-income Minnesotans. We support efforts to make our tax system more fair, and the Working Family Credit helps us make that a reality. We hope that the House’s property tax reductions will show a similar focus on these Minnesotans.

New spending: The House’s recommendations include supplemental funding in several areas of the state budget, including:

- $172 million for economic development, including bonding, broadband expansion in Greater Minnesota, and affordable housing.

- $92 million in education, including early childhood, K-12, school lunches, and higher education.

- $75 million for health and human services.

- $50 million for transportation.

‘Bottom Line’: The House leaves $195 million unallocated – or “on the bottom line” – to “ensure a stable budget into the future.” That means these funds would be available when policymakers set the next two-year budget in the 2015 Legislative Session.

It is not the same as formally allocating those dollars to the budget reserve, although both create a cushion against future risk.

You might remember that the Governor released his supplemental budget last week. Here’s how the House priorities compare:

|

Taxes

|

New Spending

|

Budget Reserve or Bottom Line

|

|

Governor’s Supplemental Budget

|

$613 million

|

$164 million

|

$456 million (reserves)

|

|

House Budget Targets

|

$550 million

|

$488 million

|

$195 million (bottom line)

|