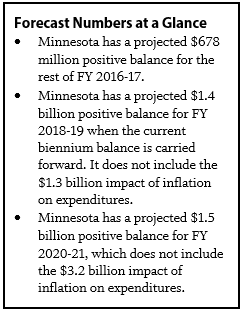

The November 2016 Economic Forecast brought some fairly good news. The state of Minnesota continues to be in positive budget territory, with a $678 million positive balance for the current two-year budget cycle, FY 2016-17.[1] Minnesota also has a projected $1.4 billion positive balance for the upcoming FY 2018-19 biennium and a $1.5 billion positive balance for FY 2020-21. The state’s economy is improving and performing better than the U.S. economy on some measures, but economic growth is expected to be less robust than in previous projections.

In the 2017 Legislative Session, policymakers will put together the budget for the upcoming FY 2018-19 biennium. They will be doing so at a time of significant uncertainty about the timing and scope of potential federal policy changes that could have a big impact on the economy, the state’s budget and Minnesota residents. In this context, policymakers should prioritize strategic tax and budget choices that enable more Minnesotans to get and keep quality jobs and access ladders into the middle class. Lawmakers must avoid passing large and unsustainable tax cuts that would prevent building a broader and more durable prosperity in Minnesota, and would hamper our ability to respond to federal changes or the next economic downturn.

Minnesota Forecast to Have Positive Balances

The state is projected to finish the current biennium on June 30, 2017, with a $678 million positive balance. This balance is what remains after a $334 million addition to the state’s budget reserve, in accordance with state law that requires that up to one-third of a positive balance in a November Forecast be transferred to the budget reserve. After the automatic transfer, the budget reserve is now $1.9 billion, getting close to the $2.1 billion recommended by Minnesota Management and Budget for the state to be well prepared for the next economic downturn.[2]

The forecast also projects $1.4 billion to be available in FY 2018-19, including the $678 million from FY 2016-17. The FY 2018-19 figures do not include the $1.3 billion estimated cost for current levels of funding to keep up with inflation. The forecast also gives us a first glimpse into the FY 2020-21 budget cycle. Here, the state has a $1.5 billion projected surplus, but again, this does not include the $3.2 billion estimated cost for current funding levels to keep up with inflation.

The state’s economic forecasts are critical tools that policymakers and the public use to measure the state’s fiscal health and form the baseline against which spending and tax proposals are assessed. Minnesota Management and Budget prepares forecasts each November and February. State, national and global economic trends are used to estimate Minnesota’s future revenues and expenditures under current laws on taxes and spending.

For more than a decade, the official forecast figures have left out the impact of inflation in the projections of future spending. Failing to include the impact of inflation can lead policymakers to make tax and budget decisions that are not sustainable. The state’s Council of Economic Advisors recommends that Minnesota include inflation in its planning estimates so that they provide a more useful guide to policymaking.

Economic Growth Expected, But Not as Strong as Previous Projections

While it’s good news the national economy is growing, it is expected to grow more slowly than was anticipated in the February forecast. The economy is expected to grow 1.5 percent in 2016, and then annual growth is expected to hover around 2 percent from 2017 through 2021.

The forecast shows that Minnesota’s economy is still doing fairly well. As of October, unemployment in Minnesota was 4.0 percent, still a fair amount better than the national rate. But the state has also seen slowing job growth, lower demand for Minnesota goods due to global trends, as well as drag from our ever-tightening labor market. However, these trends are expected to improve, leading to increased jobs in manufacturing in 2018, for example.

Like any prediction of the future, this economic forecast is subject to risk. IHS Markit, the state’s macroeconomic consultant, assigns a 65 percent probability to their baseline economic forecast. They assign a 20 percent probability to their more pessimistic scenario in which political uncertainty both in the U.S. and abroad weakens the economy and leads to a short recession starting in late 2017, and a 15 percent probability to an optimistic scenario in which incomes, housing and consumer spending are boosted by higher productivity, which increases national economic growth.

It’s important to note that the economic forecast was put together before the U.S. presidential election. The state’s Council of Economic Advisors met after the election and “agreed that there is considerable uncertainty about which policy changes may be enacted in the coming years and the economic impact of those changes.”

Positive Balances Due to Several Factors

The projected surpluses are due to a number of factors. In the current biennium, tax revenues overall are expected to come in about on track, with FY 2016 coming in stronger and FY 2017 expected to be weaker than prior projections. This is paired with lower anticipated spending, primarily in health care and home and community-based services. In FY 2018-19, revenues are expected to be lower than previous estimates. However, lower projected spending in health care, primarily in Medical Assistance and long-term care waiver services, contributes to the projected surplus.

The FY 2020-21 estimates are our first look at that biennium, and while the forecast projects a substantial positive balance, it also cautions against reading too much into these numbers. These numbers assume that spending for most services will continue at FY 2017 levels, and only includes funding adjustments in areas like school enrollment and health care caseloads. The forecast also assumes continued economic growth throughout FY 2020-21, which would amount to over 10 years of economic growth since the last recession. In the past 50 years, the U.S. has experienced a recession every five or six years on average; such sustained economic growth into the FY 2020-21 biennium would be unprecedented.[3]

Policymakers Should Maintain Progress Toward Broad Prosperity, Prepare for Uncertain Future

This November forecast gives Governor Mark Dayton the baseline information he will use to put together his proposed FY 2018-19 budget, which he will release later in January. As he and other policymakers make tax and budget decisions this legislative session, they should practice great caution, as there is increased uncertainty around policy changes at the federal level, and it’s likely that the next recession is not too far away. Policymakers should focus on targeted investments that expand opportunity and enable Minnesotans to thrive, and prepare for the uncertain future by not making large and unsustainable tax cuts or weakening the budget reserve.

Potential federal tax and budget changes could take a big bite out of the resources Minnesota uses to provide health care and other essential services, and at the same time, increase pressure for the state to respond to Minnesotans’ needs. For example, two major platforms of president-elect Donald Trump’s campaign were a tax plan that would reduce federal revenues by $6.2 trillion over 10 years [4] and repeal of the Affordable Care Act, which could leave 30 million people without health insurance.[5] Substantial changes to nutrition assistance and other portions of the safety net are being considered as well. A large scale reduction of federal revenues would mean deep cuts to funding streams that state and local governments use to provide local services, and could erode the state’s tax base as well. If the Affordable Care Act is repealed and replaced with plans similar to what Congress has passed in previous years, the number of Minnesotans without health insurance would increase to almost 700,000 in 2019, and over a decade, the state would lose over $16 billion in federal dollars that are currently used to provide affordable health insurance for Minnesotans.[6]

In addition to potential federal changes, the economy itself is another area of uncertainty. Forecasters give a one in five chance that national and international political uncertainty leads to a short recession at the end of 2017. During a recession, the needs of Minnesotans grow just at the time that the resources our state relies on to meet those needs shrink.

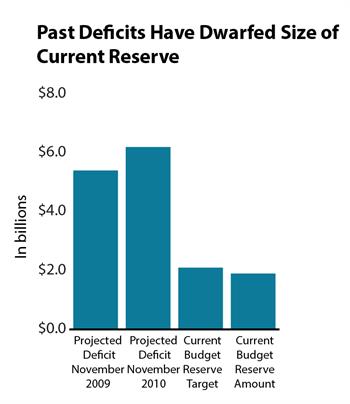

The state’s budget reserve is critical to ensuring Minnesota can adequately respond to the next downturn in the business cycle. In the same way a family might save to be able to make it through a long illness or job loss, Minnesota keeps this reserve so when a recession hits, the state can avoid drastic cuts in essential services and continue to serve Minnesotans’ needs. During the last recession, deficits were much larger than the budget reserve, and Minnesota policymakers made painful service cuts. The reserve the state is building today will be able to support struggling Minnesotans in the next economic downturn, which might not be too far away. And a healthy level of reserves will afford state policymakers the time they need to make responsible and thoughtful budget choices in response to tough economic times, instead of having to make hasty decisions to balance the state’s budget.

In addition to maintaining a strong budget reserve, policymakers should avoid making large and unsustainable tax cuts. Making large tax cuts now will make it harder to effectively respond to what’s ahead, including potential large-scale federal changes to tax policy and funding for states. Additionally, our own state history has shown that when taxes are cut too much in surplus years, it makes it more difficult to respond to the needs of our residents in the next recession.

The November forecast brought our state some good news, but policymakers would be wise not to threaten our future with unsustainable budget and tax decisions. Instead they should make strategic investments that ensure Minnesotans reach their full potential and ultimately strengthen the state’s economic future.

By Clark Biegler