The path to a stronger, more equitable future includes strengthening public services so that all Minnesotans, their families, and communities can thrive.

But that future is threatened if policymakers enact billions of dollars in poorly targeted tax cuts that leave out the most struggling Minnesotans while giving the largest benefits to high-income Minnesotans. That would be the impact of replacing Minnesota’s current income-targeted approach to Social Security income tax exemption with a blanket exemption for all income levels (often referred to as “full” or “unlimited” Social Security exemption).

The resulting tax cuts are tilted toward those with the most resources and would prevent making strong and sustainable investments in schools, health care, child care, housing, and other public services that would create a brighter future for us all.

This issue brief looks at why higher-income Minnesotans get the most benefit from an unlimited exemption, who benefits from existing Social Security exemptions, and the trade-offs from spending more than $1 billion each budget cycle on these tax cuts.

Exempting all Social Security benefits gives the biggest tax cuts to higher-income households

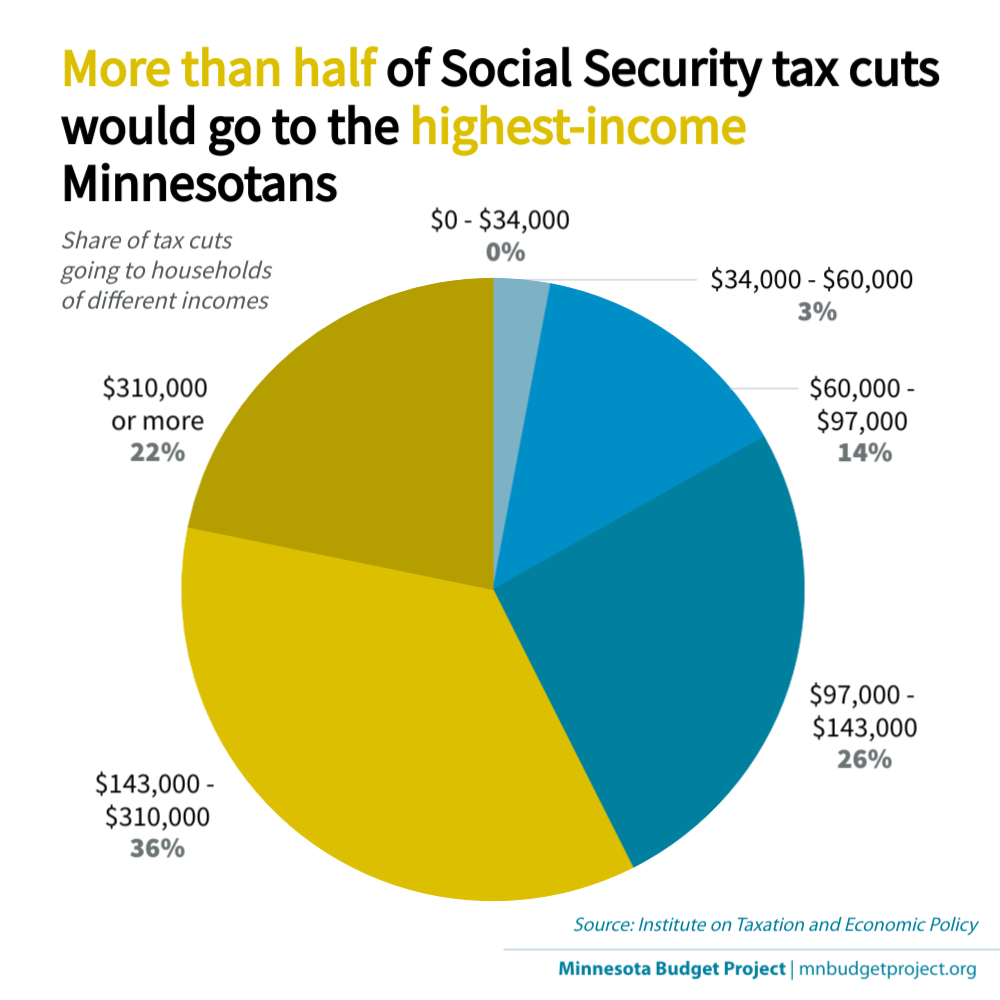

If this proposal is intended to help seniors struggling to get by on fixed incomes, it fails to meet that goal. The lowest-income seniors see no benefit. More than half of the tax cuts from adopting an unlimited exemption would go to households with incomes above $143,000 – folks who are among the 20 percent of Minnesotans with the highest incomes.[1] These high-income households would receive annual tax cuts averaging more than $2,000 simply because Social Security benefits are one of their sources of income.

Modest-income Minnesotans are much less likely to get any tax cut, and any tax cut they receive would be smaller. For example, households with incomes over $310,000 would get an average tax cut more than nine times what households with incomes $34,000 to $60,000 would receive, and nearly 4.5 times more than what households with incomes $60,000 to $97,000 would receive – if they receive any tax cut at all.

|

Household Income |

Share of this income group that would receive a tax cut |

Average tax cut |

|

Less than $34,000 (Lowest 20%) |

0% |

$0 |

|

$34,000 – $60,000 (Second 20%) |

6% |

$353 |

|

$60,000 – $97,000 (Middle 20%) |

17% |

$728 |

|

$97,000 – $143,000 (Fourth 20%) |

19% |

$1,179 |

|

$143,000 – $310,000 (Next 15%) |

19% |

$2,229 |

|

$310,000 or more (Top 5%) |

23% |

$3,264 |

Proponents of this proposal often speak to the economic struggles that some Minnesota seniors are facing. But it is not necessary or effective to provide permanent tax cuts to the wealthiest in order to help those folks currently facing financial struggles.

Federal and state tax laws target Social Security exemptions by income

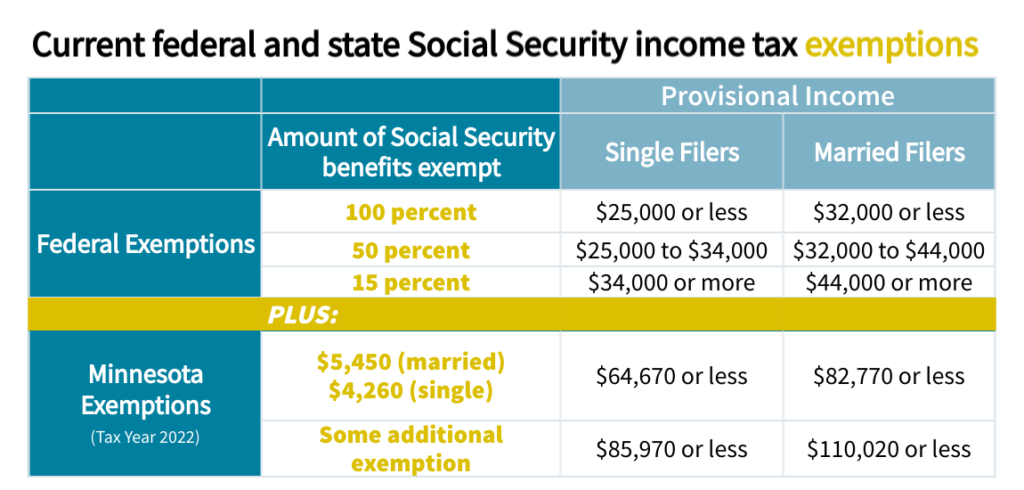

The benefits of unlimited Social Security exemption are so tilted towards higher-income households because federal and state tax laws already provide tax exemptions for Social Security benefits that prioritize lower- and middle-income seniors.

Which Social Security benefits are exempt and which are taxable is complicated and not well understood.[2] Under federal tax laws, the lowest-income folks don’t pay any federal income taxes on their Social Security benefits, and everyone has at least 15 percent of their Social Security benefits exempt. Minnesota follows this practice and provides an additional state income tax subtraction.[3]

For the 2022 tax year, for example, married couples with provisional incomes up to $82,770 can exempt an additional $5,450 of Social Security benefits from state income taxes on their joint return. Married couples with incomes above these thresholds can subtract smaller amounts of Social Security benefits from their taxable income until their provisional incomes reach $110,020.[4] A similar subtraction is available for other filing types, as shown in the table below. Both the income thresholds and amount of Social Security benefits that can be exempted under this state subtraction are adjusted each year with inflation.

How much Social Security is tax exempt at the state or federal levels depends on a household’s provisional income, which is their Federal Adjusted Gross Income minus taxable Social Security benefits, then adding some other kinds of income, including nontaxable interest and 50 percent of Social Security benefits.[5] This will be less than a household’s total income.

Further, just because Social Security benefits are included in a household’s taxable income, does not mean they will pay taxes on them. Like all Minnesotans, Social Security beneficiaries also take standard or itemized deductions that further reduce their taxable income.

The current system avoids “double taxation.” The 15 percent federal exemption was established so that Social Security benefits were treated similar to defined benefit pensions. As House Research notes, “Retirement income is typically taxed either when the income is saved/contributed, or at the time the income is received, but not both.” Federal actuaries determined that at most, 15 percent of the Social Security benefits that people receive represent what they themselves paid into the system and have already paid income taxes on.[6]

Large tax cuts threaten essential public services

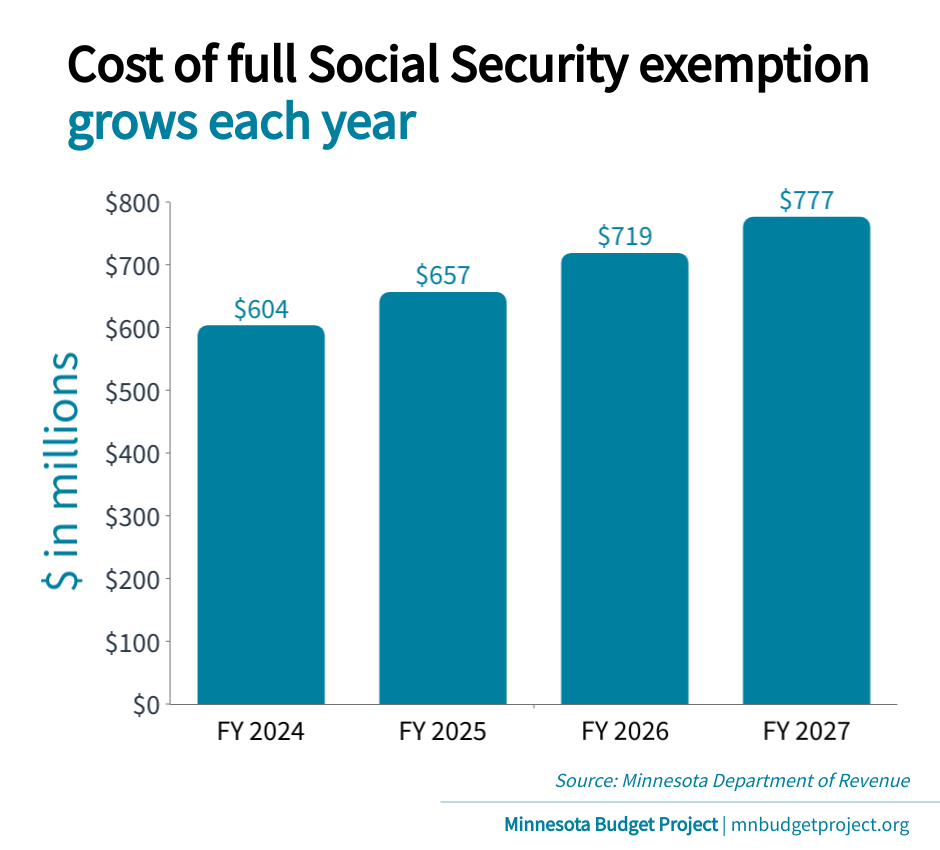

Estimates from the Minnesota Department of Revenue demonstrate the high cost of this proposal and how it would grow over time from $604 million in FY 2024 to $777 million in FY 2027.[7]

These expensive tax cuts would come at a high price. They would erode state revenues and threaten the services seniors count on, whether those are community-based services to help them to stay in their homes, transit services to get to the doctor or shopping, or high-quality nursing home care. The seniors struggling the most to pay the bills would feel the greatest harm from potential future cuts in these services while also being largely left out of any benefit from the tax cuts.

Proponents of this tax cut point out that there are other states that don’t tax Social Security income. But those other states are facing severe financial challenges down the road that will make it more difficult to provide the services seniors count on, or to invest in families and communities. The Center on Budget and Policy Priorities estimates that the cost of senior tax breaks provided by states will more than double from 2017 to 2030 with the growth of the senior population.[8]

Some argue that the state’s large projected surpluses mean we can afford these tax cuts. But this ignores the fact that the surpluses available today won’t be there in the long run. A substantial portion of the current budget surpluses are being driven by short-term factors, including the positive effects that federal COVID-response and economic stimulus legislation have had on the economy, household incomes, and state budgets. To put the ongoing costs in perspective, the $1.5 billion projected cost of unlimited Social Security exemption in FY 2026-27 is nearly 18 percent of the structural balance projected for that two-year budget cycle.[9]

There are better ways to create a brighter future for all

Rather than this expensive proposal that gives the largest tax cuts to high-income seniors, Minnesota should continue to take a targeted approach to Social Security exemption that protects sustainable funding for the public services that Minnesota seniors – and their children, grandchildren, friends, and neighbors – count on.

By Nan Madden

[1] The data in this brief on the distribution of tax cuts by income group and average tax cut amounts are from Institute on Taxation and Economic Policy (ITEP), January 2023, and model the impact on Minnesota residents. Analysis from Minnesota Senate Counsel, Research, and Fiscal Analysis (SCRFA) finds broadly similar results. The major differences in the modeling are who is included and what definition of income is used. ITEP’s analysis is of all Minnesota residents (including those who do not file income taxes) based on their household income, whereas SCRFA analysis is of those who file Minnesota income taxes (including non-residents) based on their Federal Adjusted Gross Income.

[2] The Minnesota House Research Department has an online calculator that estimates state income taxes under current law and under a full exemption for households with various income levels. Visit https://www.house.leg.state.mn.us/hrd/issinfo/sstaxes.aspx.

[3] Minnesota House Research Department, Taxation of Social Security Benefits in Minnesota, August 2020.

[4] Minnesota Department of Revenue website, Social Security Benefit Subtraction, accessed January 15, 2023.

[5] “The deductions that are added back in calculating provisional income are: adoption expenses, student loan interest, tuition expenses, certain foreign income, and income from Puerto Rico and certain other U.S. territories.” Minnesota House Research Department.

[6] Minnesota House Research Department, Taxation of Social Security Benefits in Minnesota. See also Minnesota Center for Fiscal Excellence, Fire up the Seniors: The Push to Exempt Social Security, February 25, 2020.

[7] Minnesota Department of Revenue, Revenue analysis of S.F. 15, January 11, 2023.

[8] Center on Budget and Policy Priorities, States Should Target Senior Tax Breaks Only to Those Who Need Them, Free up Funds for Investments, June 2019.

[9] Minnesota Budget Project calculations based on Minnesota Management and Budget, Budget and Economic Forecast, November 2022.