Starting January 1, 2014, Minnesotans will experience a new world of health insurance options, thanks to the state’s new insurance exchange, MNsure. MNsure is an online marketplace where individuals and small employers will be able to shop for, compare and enroll in insurance. Although two-thirds of Minnesotans will continue to get health insurance directly through their employers, nearly 1.3 million Minnesotans are expected to use MNsure to find private or public health insurance.

Currently, about 500,000 Minnesotans have no health insurance, and many others have inadequate coverage. These Minnesotans often delay getting care when they are sick, eventually turning to expensive emergency room services. They also struggle to pay their health care bills, leading to medical debt for themselves and uncompensated costs for health care providers. These inefficiencies drive up health care costs for everyone.

MNsure and other reforms in the federal Affordable Care Act are expected to reduce the number of Minnesotans without health insurance to 200,000 by 2016.[1] More Minnesotans with insurance coverage means a state where more people can promptly seek medical attention and pay their health care bills. Creating a continuum of affordable health insurance for people at all income levels will lead to a healthier population and a more efficient health care system. This issue brief focuses on opportunities to enroll in private and public health insurance that will be available to individuals through MNsure starting in 2014.

Federal Assistance Will Reduce the Cost of Private Health Insurance

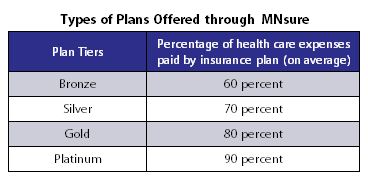

Minnesotans purchasing private health insurance through MNsure will choose from four tiers of plans – bronze, silver, gold and platinum. The difference between these tiers is the share of health care costs paid by the insurance plan, versus the out-of-pocket expenses paid by the person. For example, in a bronze plan, the insurance plan will pay 60 percent of the covered health care expenses for the average person. The individual will pay approximately 40 percent of the expenses through copayments and deductibles. In higher tier plans, the individual pays a higher monthly premium, but pays less in copayments and deductibles.

The Affordable Care Act provides federal tax credits and cost-sharing assistance to make quality health insurance more affordable.

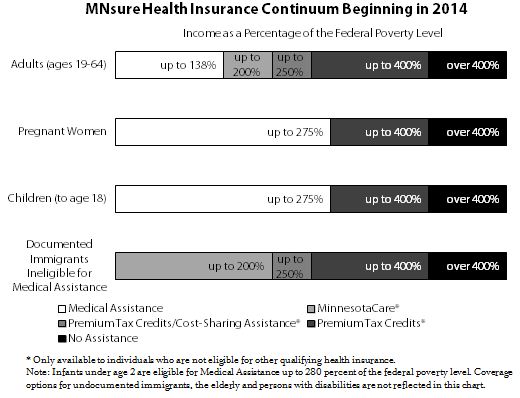

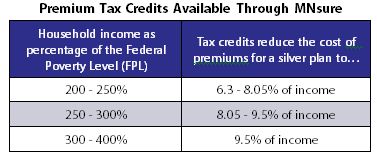

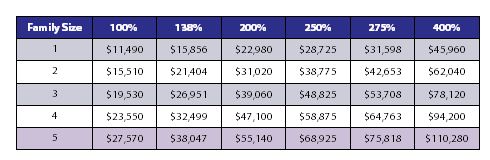

Premium Tax Credits. In Minnesota, federal tax credits will be available to individuals with incomes between 201 and 400 percent of the federal poverty level, who are U.S. citizens or legally residing in the country, and are not eligible for other qualifying insurance.[2] The tax credits make monthly premiums more affordable by capping them as a share of income. They are only available for coverage purchased through MNsure.

This tax credit is available immediately to reduce the cost of monthly premiums. The amount of the credit is based on an estimate of a household’s income for the year. If a household’s income ends up higher than predicted, they may have to pay back some or all of the credit they received. If their income ends up lower than anticipated, the household will receive an additional tax credit when they file their income taxes. People can lower their risk of having to repay tax credits by promptly reporting any change in their income or tax filing status to MNsure, requesting a smaller credit than they qualify for, or by waiting to receive the credit as a lump sum when they file their taxes. The Affordable Care Act caps the amount that must be repaid as long as household income stays below 400 percent of the federal poverty level.

Cost-sharing assistance. Federal cost-sharing assistance will reduce out-of-pocket expenses, like deductibles and copayments, and is available to Minnesotans with incomes from 201 to 250 percent of the federal poverty level, who qualify for a premium tax credit, and purchase a silver plan through MNsure. In Minnesota, the cost-sharing assistance will slightly improve the value of a silver plan, with a person only paying on average 27 percent of expenses out of pocket, instead of 30 percent.

Households with incomes above 400 percent of the federal poverty level are not eligible for any state or federal financial assistance to purchase health insurance. However, they may continue to purchase private insurance through MNsure and take advantage of the information and consumer-friendly tools it provides.

MinnesotaCare Will Be More Affordable

Adults with incomes between 139 and 200 percent of the federal poverty level who are eligible to apply for insurance through MNsure will qualify for public coverage through MinnesotaCare.[3] MinnesotaCare has been making affordable health care insurance available to working families for more than 20 years through a state-federal partnership. MinnesotaCare enrollees pay lower premiums than they would for private insurance, have low out-of-pocket costs and a broad benefit set. Recent improvements to MinnesotaCare lowered premiums and cost-sharing, ended limits on inpatient hospital coverage and eliminated waiting periods.

By 2016, nearly 200,000 people are expected to be enrolled in MinnesotaCare. Those eligible include:

- Adults ages 19 to 64 with incomes from 139 to 200 percent of the federal poverty level who do not have access to other qualifying insurance.

- Lawful immigrants with incomes at or below 200 percent of the federal poverty level who do not have access to other qualifying insurance, including those with incomes below 139 percent of poverty who are ineligible for Medical Assistance.[4]

Medical Assistance Will Cover More Minnesotans

Medical Assistance (also known as Medicaid) is a federal-state partnership that provides an affordable health insurance option with no premiums and very low out-of-pocket costs to children, pregnant women, parents, and adults without children in Minnesota. Enrollees in Medical Assistance can access comprehensive health care coverage, including chronic disease care, mental health treatment, hospital care, interpreter services and long-term care. Minnesota made improvements to Medical Assistance required by the Affordable Care Act, including a streamlined application process, automatic renewals and removal of the asset test.[5]

Individuals may enroll in Medical Assistance as long as they meet the income requirements, regardless of whether they have access to insurance through their employers. As a result of the Affordable Care Act, eligibility for Medical Assistance has been expanded to include:

- Parents, adults without children, and 19- and 20-year-olds with incomes up to 138 percent of the federal poverty level.

- Children and pregnant women with incomes up to 275 percent of the federal poverty level (infants under age 2 are eligible up to 280 percent of the federal poverty level).

Current Coverage Options Continue for Seniors, People with Disabilities and Undocumented Minnesotans

For the vast majority of Minnesotans who struggle to find affordable health insurance, MNsure will open the door to new and better opportunities. But not all Minnesotans will use MNsure. Many individuals with employer-sponsored insurance, as well as seniors, people with disabilities and undocumented immigrants will generally continue to use their current path to health care coverage.

Seniors. Minnesotans age 65 and older will continue to enroll in Medicare (and Medical Assistance) as they have in the past, rather than using MNsure. The Affordable Care Act improves Medicare by adding free preventive care, moving to close the “donut hole” in prescription drug coverage, and increasing payments to primary care doctors to improve access. Unfortunately, the recent improvements in Medical Assistance, including increasing income eligibility and eliminating asset limits, do not apply to seniors.

Minnesotans with disabilities. For some Minnesotans with disabilities – those who need additional financial assistance or require more long-term care services – little is changing. These Minnesotans must continue to get an official disability determination so that they can access Supplemental Security Income, Social Security Disability Insurance and some waivered services. As with seniors, the recent improvements in Medical Assistance, including increasing income eligibility and eliminating assets limits, do not apply.

However, some people with disabilities will benefit from the reforms in the Affordable Care Act. If they do not require financial assistance or more extensive long-term care services, they can enroll in public or private insurance through MNsure and not go through the Social Security disability determination process. Opportunities include:

- Lower-income individuals with limited disabilities are more likely to qualify for regular Medical Assistance, since the income limit will be increased and asset limits are being removed.

- Others may be able to enroll in private insurance. The Affordable Care Act removes barriers that previously prevented people with disabilities from purchasing private insurance by ending pre-existing condition exclusions, eliminating annual or lifetime caps on covered benefits, prohibiting health status from being used to calculate premiums, and requiring guaranteed issue and renewal of policies.

Undocumented immigrants. People residing in the U.S. without official permission are not eligible for public health care programs or health care tax credits and subsidies, and cannot purchase private insurance through MNsure. In Minnesota, undocumented immigrants may be eligible for Emergency Medical Assistance, which provides coverage for emergency medical conditions, dialysis and cancer treatment. Minnesota has funded a grant to help undocumented individuals adjust their immigration status, potentially allowing them to qualify for better health insurance options.

MNsure Opens for Business October 1, 2013

Individuals can begin to enroll in insurance through MNsure starting October 1, 2013. Hundreds of thousands of small business employees will also be enrolling in health insurance through MNsure using the Small Business Health Options Program (SHOP). When coverage begins on January 1, thousands of uninsured or underinsured Minnesotans will have greater peace of mind knowing there are better and more affordable health insurance options for themselves and their families. And all Minnesotans will benefit from living in a state with a healthier population and a more efficient health care system.

By Christina Wessel

Appendix: 2013 Federal Poverty Level by Family Size

[1] Updated Gruber and Gorman Analysis of ACA, Exchange and BHP/Wrap Impact on Minnesota, PowerPoint presentation to Access Working Group, January 2013.

[2] Other qualifying insurance includes government insurance (such as Medical Assistance, MinnesotaCare or Medicare) or employer-sponsored insurance that is affordable (costs no more than 9.5 percent of annual family income) and meets a minimum value (covers at least 60 percent of health care costs).

[3] Pregnant women with household income in this range are eligible for Medical Assistance.

[4] Most immigrants must have legal status for five years before they become eligible for Medical Assistance.

[5] The elderly (age 65 and older) and persons with disabilities who qualify for Medical Assistance based on disability status will continue to be subject to current income and asset limits.