Growing income inequality contradicts some of our country’s most deeply held values. Americans believe that hard work should pay off, that people who work full time should be able to support their households, and that everyone should have the opportunity to succeed.

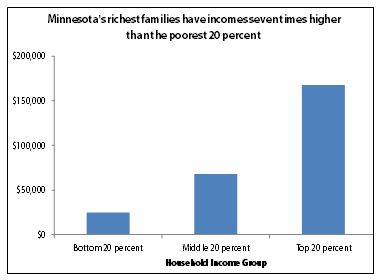

The income gap between Minnesota’s high-income and low- and middle-income households has grown so wide that by the late 2000s, the richest 20 percent of Minnesota households have average incomes that are seven times larger than the poorest 20 percent and 2.5 times as large as the middle 20 percent.[1] Furthermore, the richest five percent of households have average incomes 11 times greater than the poorest 20 percent.

The income gap has grown in the short and long term. Minnesota saw a significant increase in income inequality from the late 1990s to the mid-2000s, when the earnings of high-income households grew while low- and middle-income households’ earnings fell.[2] The poorest 20 percent of households in the state experienced an $800 decrease in their incomes over the business cycle when adjusted for inflation, while the richest 20 percent saw an almost $10,000 increase. The difference in income between the richest and poorest households in the state grew by almost $11,000 during this time period.

Growing inequality is not a new trend in Minnesota. From the late 1970s to the mid-2000s, high-income households saw much more income growth than other Minnesotans.[3] Minnesota’s high-income households saw an almost 80 percent increase in their incomes over this time span, while middle-income households’ income grew by 41 percent, and low-income households’ incomes grew by less than 20 percent.

There is a bit of good news here though: Minnesota’s income gap is smaller than in 34 other states. However, Minnesota has not been immune to the damaging trend of growing income inequality, which poses a real threat to our state’s future prosperity.

The Causes of Rising Income Inequality Include Wage and Investment Trends

Several national trends have contributed to the rise in income inequality. Among the most prevalent are rising wage inequality and the increasing value of investment income.

Inequality in wages is the greatest contributor to growing income inequality nationally. The highest-paid workers saw strong wage growth, while those at the low end of the wage scale saw their wages grow only moderately or even stagnate over the past 30 years. This trend is a result of periods of high unemployment, economic globalization, a shrinking manufacturing sector and the rise of the service economy, declining unionization and the decreasing value of the minimum wage. All of these factors suppressed wages at the bottom of the income ladder.

Meanwhile, those at the top of the income scale benefited from the increasing value of investment income, which became a larger share of total income during the 1990s. So not only have high-income households seen their wages grow more rapidly over the past decade, they have also seen strong growth in their investment income, including interest, dividends, and capital gains. Low- and middle-income households get most of their income from wages, not investments.

Policy Choices Can Narrow the Gap

The experience of the past 30 years demonstrates that economic growth alone does not reduce income inequality. States can take action to decrease income inequality or alleviate some of its devastating impacts. These include:

- Policies that improve job quality, such as increasing the state minimum wage and focusing on job quality in economic development;

- Tax policies that ensure that all Minnesotans pay their fair share;

- Policies that support low-wage workers, including child care assistance, health care, and access to higher education and skills training.

Stagnant wages at the low end of the income scale were a clear contributor to growing income inequality. The failure of the minimum wage to maintain its buying power is clearly part of this picture. The minimum wage would need to be $9.22 to have the same buying power as it did at its high point in 1968.[4] The minimum wage is $7.25, or $15,080 a year for full-time, year-round work. This falls far short of the $24,588 that it takes for a single adult to make ends meet in Minnesota, let alone what it takes to support a family.[5] Increasing Minnesota’s minimum wage and then indexing it for inflation can go a long way toward ensuring that those who work hard can support themselves and their families, and narrow the income gap.

Minnesota’s tax system also contributes to income inequality, since low- and middle-income households pay a higher share of their incomes in state and local taxes than the highest income households. A Minnesota household making over $429,354 pays 9.7 percent of its income in state and local taxes, while a middle-income household making $53,315 to $68,696 pays 12.1 percent.[6] Minnesota’s growing reliance on local property taxes is one contributor to this problem. Reforming the tax system so the responsibility for funding public services is shared more fairly will ensure that the state doesn’t make income inequality even worse.

Finally, the state can do more to support low-wage workers and thereby alleviate the effects of growing income inequality. Supports for low-wage workers include a strong unemployment insurance system that replaces lost income during times of unemployment, access to affordable education and job training, and affordable early childhood education that allows parents to work and prepares their children for success in school.

The federal Affordable Care Act makes it possible to increase access to affordable, quality health care. The state should take the opportunity to provide health coverage to more Minnesotans through Medicaid and to receive federal funding to continue affordable, comprehensive health insurance through MinnesotaCare for Minnesota’s working families.[7]

Income Inequality is a Threat to Our Future

As the income gap widens, different standards of living mean that people become isolated from each other. This isolation undermines a sense of shared destiny and weakens trust in our public institutions. In addition, income inequality fosters a society in which some members have greater influence in the political process than others.

While income inequality is a growing problem in our state, by investing the right resources in the right places Minnesota can work to mitigate this trend and ensure that everyone has a chance to succeed. It’s the right thing to do for all of us. Minnesota’s most important investments are its people, and when so many are being left behind, the state cannot thrive.

By Caitlin Biegler and Nan Madden