All Minnesotans deserve to be healthy. Good health shouldn’t depend on the size of someone’s paycheck or their address. Thankfully, our state recognizes this. Minnesota has a long history of investing in our health and the things that support our well-being. In 1992, Minnesota policymakers made an essential investment when they created the health care provider tax, a critical funding source for affordable health care options; improved access to doctors, physical therapists, and mental health providers; and better health in communities in every corner of our state.[1]

But now these investments are at risk. The provider tax expires at the end of 2019, which would result in around a $700 million annual loss in dedicated funding for health care in Minnesota.[2] In the 2019 Legislative Session, Minnesota policymakers must act to extend the provider tax in order to preserve health care for over one million Minnesotans, and keep moving us forward toward becoming a state where good health is available to all.

What is the Provider Tax?

The Minnesota Legislature passed a bipartisan health care reform package 26 years ago aimed at getting more Minnesotans health care coverage, and created the health care provider tax to help fund these reforms. Health care providers, hospitals, surgical centers, and wholesale drug distributors pay 2 percent of their gross revenue into the Health Care Access Fund.

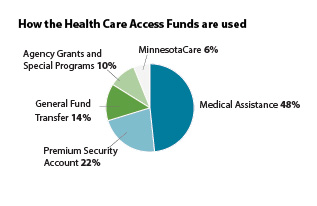

Provider tax revenues are the primary source of funding for the Health Care Access Fund, which then goes toward investments in Minnesotans’ health and well-being. These investments primarily support affordable health care programs like MinnesotaCare and Medicaid (which also goes by the name Medical Assistance), and other public health priorities.

Over one million Minnesotans get affordable health care coverage through MinnesotaCare and Medicaid. These include working Minnesotans who don’t have affordable insurance through their employers. Others are seniors or Minnesotans living with disabilities.

In 2017, the Legislature also used the Health Care Access Fund to pay $401 million in FY 2018-19 for a reinsurance program to lower premiums for Minnesotans who buy health insurance on the individual market.

Unfortunately, these investments are at serious risk unless policymakers take action to maintain this funding source. That’s because in 2011, the Legislature voted to repeal the provider tax starting in 2020 as part of a compromise to pass the state budget and end a 19-day state government shutdown.

Why is the Provider Tax So Important Right Now?

Despite Minnesota’s progress on health, we still have important challenges as a state. If Minnesota loses the provider tax, it will be a serious blow to the its ability put affordable health care in reach for all communities and respond to current challenges that include:

- Uncertainty about federal funding. The federal government is a partner with Minnesota in funding health care programs, but has been a less reliable one in recent years. There been serious federal proposals to cut back on the federal government’s commitment to funding affordable health care, and recently Minnesota has received less federal funding for its reinsurance program than it expected. This uncertainty underscores the importance of Minnesota having strong, state-based revenues to fund our health care priorities.

- Racial equity. Many of Minnesota’s communities of color face significantly higher rates of premature death than their white neighbors and are more likely to lack access to health care.[3] Good health should be attainable to all, and the state must dismantle the barriers to living healthy lives that some Minnesotans of color face. Since people of color are disproportionately likely to be earning lower incomes in Minnesota, maintaining the ability to attain affordable coverage through Medicaid and MinnesotaCare is essential, and more steps are needed to ensure that people of color have access to health care providers who understand their needs.

- Rural access. Primary care providers, dentists, mental health providers, and many other caregivers are in short supply in many rural communities.[4] State investments to help health care providers serve rural communities may disappear if the provider tax expires, making it harder for Minnesotans in these communities to get the critical care they need and deserve.

What Happens if the Provider Tax Expires?

Without the provider tax, Minnesota will struggle to continue its progress in the promotion of healthy communities with the health care providers and services that Minnesotans need.

If the provider tax expires, it will be a loss of around $700 million annually. The Health Care Access Fund will lose 80 percent of its revenue by 2022, and the state’s health and human services budget, which funds everything from disability services to child protection, will be under significant stress.[5]

If the provider tax expires, it will be a loss of around $700 million annually. The Health Care Access Fund will lose 80 percent of its revenue by 2022, and the state’s health and human services budget, which funds everything from disability services to child protection, will be under significant stress.[5]

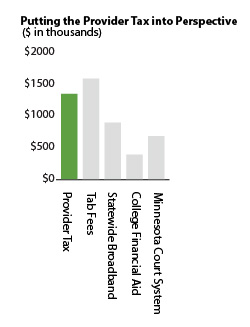

Some have argued that the provider tax should be allowed to expire, and the state should find the money for essential health care investments in the state’s general fund. That would have serious consequences for other public services that Minnesotans value. A budget hole of this magnitude creates stress on other important priorities and could constrain investment in the future of Minnesota, in areas such as K-12 education, financial aid for college students, statewide access to broadband, and new roads, bridges, and transit.

Policymakers Should Take Action in 2019 to Maintain the Provider Tax

Minnesota doesn’t have to put important investments in Minnesotans’ health and well-being at risk. The provider tax is a revenue source that is proven to fund essential investments, and no strong alternatives have arisen in the seven years since the sunset was enacted.

Minnesotans should expect their policymakers to take responsible action this year to repeal the sunset of the provider tax, and end the uncertainty about the future for affordable health care coverage and investments in healthier communities.

By Sarah Orange and Nan Madden