Federal COVID-19 relief actions reduced hardship during the pandemic and the dramatic economic disruption it caused in 2020, according to the latest U.S. Census data. Federal policymakers responded to the overwhelming harm of the pandemic to protect Americans’ health, bolster their incomes, and meet basic needs. They did so with historic expansions of our nation’s unemployment insurance system, tax credits for low-income families, and food assistance; several rounds of economic stimulus payments; and expanded funding and protections for affordable health care. Minnesota policymakers in many ways followed suit. The recent data show these policies worked.

However, the COVID-19 pandemic has disproportionately harmed low-income and Black and Brown Americans, and highlighted inequality across lines of race, income, and geography that predate the pandemic. The recent Census data gives us a kind of “report card” on the federal policy response so far -- it shows us the positive impact of choices taken to date, and demonstrates why additional policy actions are needed to build a stronger, more equitable economy.

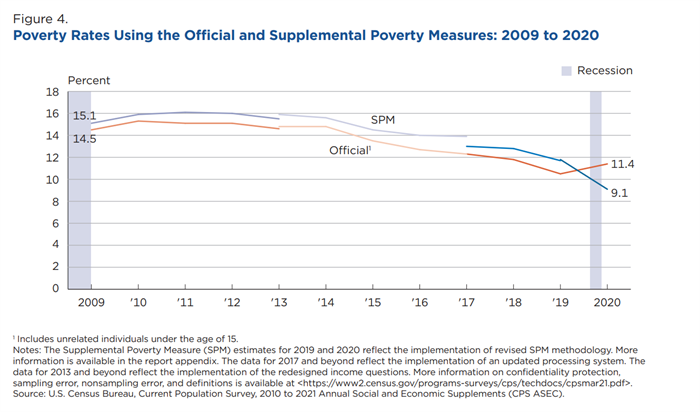

One important metric from the Census release is the Supplemental Poverty Measure (SPM), which is better than the official poverty measure to assess whether Americans can afford the essentials. The Supplemental Poverty Measure includes the effects of anti-poverty efforts such as food assistance through SNAP, tax credits that boost the resources of lower-income families, and low-income heating assistance, as well as how much basic needs, like health care, cost.

For the first time since it was constructed, in 2020 the Supplemental Poverty Measure showed fewer people in the United States (specifically, 7.5 million) were living in poverty than the official poverty measure showed. This demonstrates the power of COVID-response policy actions in improving economic well-being. In 2020, the official poverty rate for the nation was 11.4 percent, while the supplemental poverty rate was 9.1 percent.

In Minnesota, 7.3 percent or 415,000 people lived in poverty, according to the official poverty measure, while the Supplemental Poverty Measure pegs the state figure at 5.9 percent, or 332,000 people. (These figures are averages for the years 2018 to 2020.)

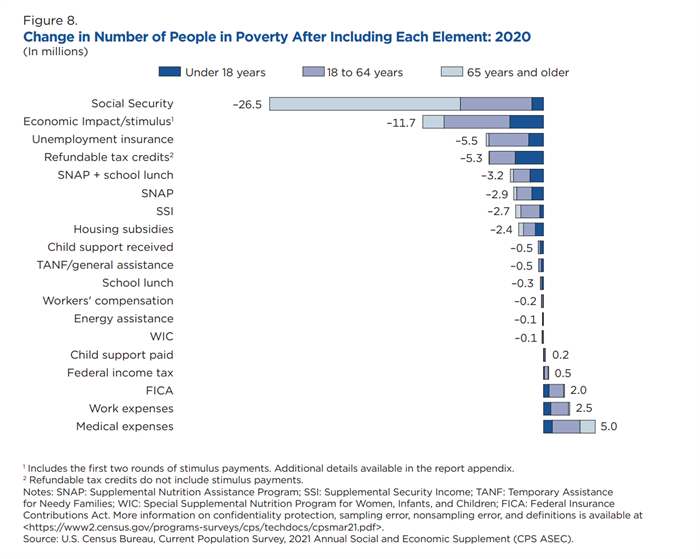

The latest data also show how recent federal policy actions were successful in boosting many Americans’ incomes even during a year of record-breaking unemployment. For example, federal policymakers enacted robust expansions of unemployment insurance to include many jobless workers normally left out and providing more robust income supports. The improved UI system prevented 5.5 million people from falling into poverty. Refundable tax credits for people earning lower wages, like the Earned Income Tax Credit and Child Tax Credit, also had a powerful effect, preventing 5.3 million Americans from living in poverty, including 2.7 million children.

While there is a lot of good news in the Census report, still too many Americans did not have enough to get by. The data also demonstrate once again the United States’ deep divides in economic security by race and ethnicity, reflecting historic and ongoing discrimination in education, housing, and employment that systemically limits opportunity. While policy choices reduce the supplemental poverty rate for Americans of color, it’s not enough to close those gaps. Poverty rates for Black and Hispanic Americans are still much higher than the overall national figure. About 1 in 7 Black and Latinx Americans live in poverty, according to the Supplemental Poverty Measure. These figures, which represent roughly 15 million Americans, show us that there’s much more to do to build an economy and system of policies that ensure all workers and families can thrive.

| |

Supplemental Poverty Rate 2020 |

Median Household Income 2020 |

| Overall U.S. |

9.1 percent |

$67,521 |

| Black Americans |

14.6 percent |

$45,870 |

| Latinx Americans |

14.0 percent |

$55,321 |

| Asian Americans |

8.8 percent |

$94,903 |

| White, non-Latinx Americans |

6.5 percent |

$74,912 |

| *The data released does not include figures for Native Americans, nor does it disaggregate further by race. As a result, the data do not tell the complex stories of our nation. |

The data released last week paints a picture of the experience in 2020. When we look at more recent Census data that surveyed people this August, it’s clear that hardship is still far too prevalent, even as the economy and labor market have begun to improve. It’s still the case that 17.6 million American adults, including 190,000 Minnesotans, were not able to get the food they need. One in seven renters nationwide, including 88,000 Minnesotans, are behind on rent. And almost 60 million Americans are having trouble affording basic expenses, including 749,000 Minnesotans.

Right now, federal policymakers are considering Build Back Better recovery legislation that would build upon the progress made over the past year, fill in the holes in the safety net that the pandemic laid bare, and build a stronger, more equitable economy.

To have the greatest impact and build the future that so many Americans are calling for, this legislation should include:

- A permanent expansion of the Earned Income Tax Credit and the Child Tax Credit to continue to bolster the incomes of children, families, and workers;

- Permanent unemployment insurance reform that sets basic federal standards for coverage and benefits, building on the improvements made in last year’s COVID-19 legislation;

- Investments in affordable housing so that fewer families have to worry about keeping a roof over their heads;

- Closing the Medicaid coverage gap so that access to affordable health care doesn’t depend on what state a person lives in;

- Summer grocery benefits and expanded access to free school meals;

- Expanded investments in affordable child care and the creation of a paid leave system so that people don’t lose income or their jobs when illness strikes; and

- Raising resources from wealthy households and corporations to fund these investments and bring greater equity to our tax code.

If you would like to contact your elected officials to demonstrate your support for transformational policy changes that build on the anti-poverty successes of the COVID-19 relief legislation, you can do so at our action center.