Highlights the importance of economic supports during the pandemic

The state’s economic picture has improved compared to the November forecast, but COVID-19 and the economic fallout are still hurting many Minnesotans’ health and economic stability, according to the state of Minnesota’s recent

January Revenue and Economic Update. Some of the top takeaways from the Update include:

1.

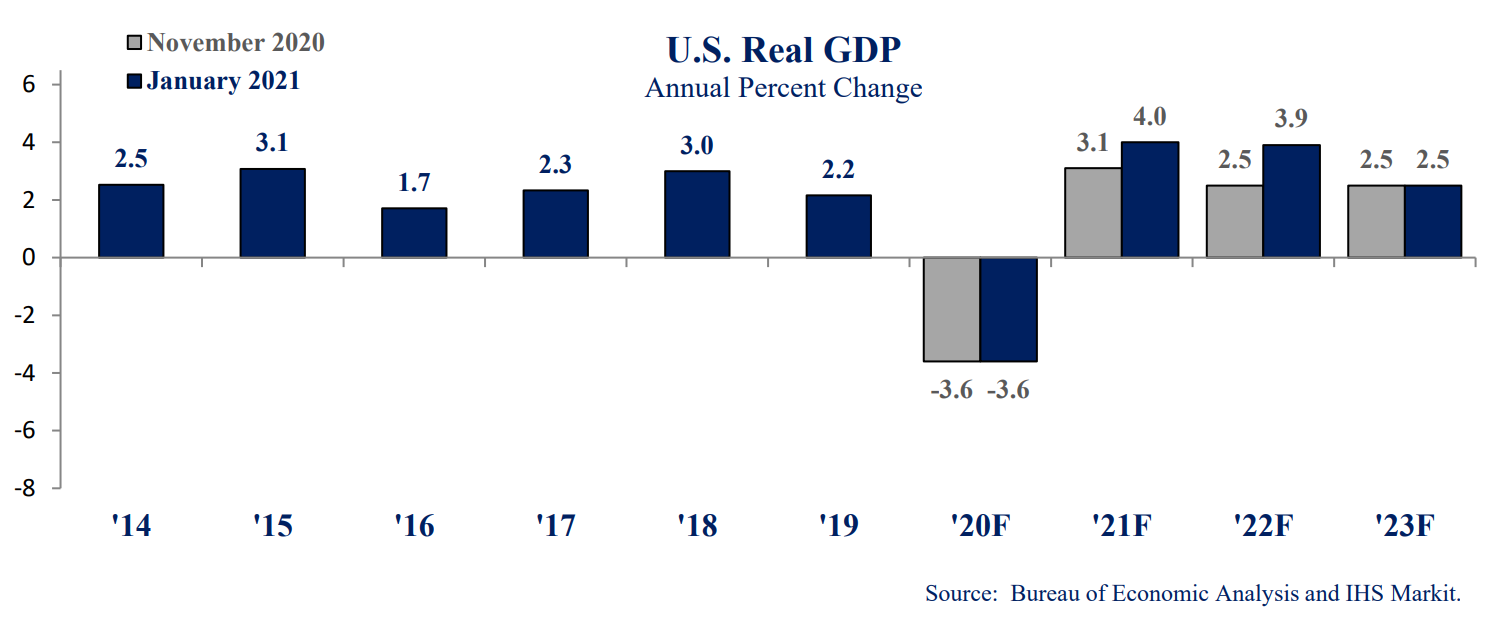

Economic expectations are somewhat improved. After a 3.6 percent reduction in the nation’s GDP last year, the economic forecasters now predict 4.0 percent growth in GDP in 2021. That’s an

improvement over economic projections from November. This good news is largely due to the recently passed federal stimulus bill, which is projected to improve the 2021 GDP by 1.3 percent, and helps offset the economic drag caused by surging coronavirus cases.

2.

State revenues to-date came in higher compared to the November forecast. Revenues for November and December 2020 came in $167 million – or 4.3 percent – higher than the earlier projection. Corporate tax revenues were the largest source of this increase. The Update notes that it is likely that uncertainty earlier in the year might have led businesses to make lower tax payments, which they then increased later in the year once they had a better understanding of their profits.

3.

Unemployment is expected to decrease over the course of 2021, but many people are still out of work. In December, the national unemployment rate was 6.7 percent -- down from the peak of 14.7 percent in April. IHS, the state’s economic forecasters, expect national unemployment will further decline to 4.3 percent by the end of 2021. However, the report notes that while the unemployment rate has declined, it doesn’t capture those who have left the labor force during the pandemic – for example, workers who have stopped looking for work for now. The national labor force participation rate is almost 2 percentage points lower than it was a year ago.

4.

Forecasters are only somewhat confident in their projections. The nation’s economic performance is dependent on the severity of the pandemic and the effectiveness of efforts to bring it under control. Uncertainty about the course of the pandemic is reflected in forecasters’ uncertainty about their economic projections. They assign a 50 percent chance that their baseline economic scenario is correct. They give a 30 percent chance for a more pessimistic scenario, in which the pandemic causes greater economic harm. They assign a 20 percent probability to a more optimistic scenario in which the impact of COVID-19 is less severe.

Minnesotans and people across the nation are still struggling, and there is an ongoing need for policymakers at all levels to respond to the health, economic, and state budget crises. Importantly, the improved economic picture shows the positive effect of the federal economic stimulus passed in December, which included an extension of unemployment insurance benefits, an additional round of stimulus checks, and financial supports for businesses.

The federal bill left out adequate funding for state, local, and tribal governments – a problem that we hope will be rectified in a future round of federal COVID and stimulus legislation in order to protect services Minnesotans are counting on and support the economic recovery. Earlier this summer,

the July economic update referenced the economic drag created by state and local government budget cuts, and noted that, “Without additional federal support, state and local governments face substantial revenue shortfalls in the coming fiscal years.”

Even with the improved revenues reported in the Update, Minnesota is likely facing structural deficits in its upcoming budget cycles, which is an important part of the context as policymakers put together the budget for FY 2022-23.

As we’ve noted elsewhere, the state’s official budget projections do not fully measure what it takes for all communities to thrive, and the gap between the state’s current funding commitments and what it is expected to collect in revenues grows larger over time.

This is a time that truly requires policymakers to

draw on the resources needed to respond to the challenges before us and do what’s needed to build a stronger, more equitable future for all of us. That includes careful use of Minnesota’s strong budget reserve, wise deployment of federal dollars, and raising raise state revenues in ways that make our tax system more equitable, fair, and just.