The recently released April Revenue and Economic Update gave us good news about the state’s economic and budget landscape. The quarterly report from Minnesota Management and Budget (MMB) showed that the most recent state revenues have come in on track, and that the national economy is expected to grow at about the same rate as predicted earlier this year.

Some of the top takeaways from the Update include:

1. State revenues are coming in on track with projections. The state’s revenues for February and March came in $6 million above projections; that’s 0.2 percent more than projected in the state’s February 2018 Economic Forecast. The slight increase is primarily due to higher income and sales taxes received. The Update notes that the state will have a fuller picture of total tax year 2017 income tax payments later in April.

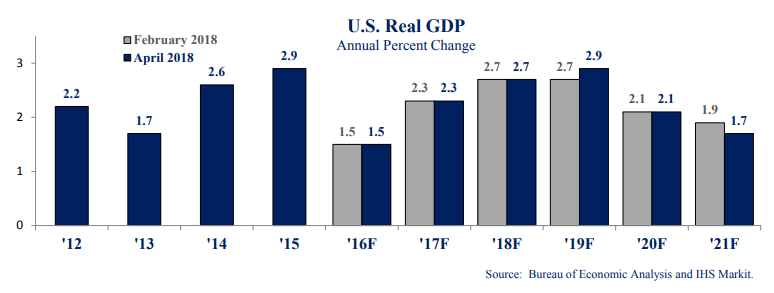

2. Economic growth is expected to be roughly on track with the February forecast. The national economic forecasters continue to predict 2.7 percent national GDP growth for 2018. In 2019, growth is projected to be higher than earlier anticipated at 2.9 percent, but then is expected to taper off to 1.7 percent by 2021.

3. National unemployment rate expected to remain low, with strong consumer spending expected. Nationally, unemployment has been holding steady at 4.1 percent. That is the lowest it’s been in 17 years. Unemployment is expected to drop to 3.6 percent in 2019, roughly what the February forecast projected.

4. Forecasters are fairly confident in their projections. The forecasters assign a 65 percent chance that their baseline forecast is correct. They also give a 20 percent chance for a more pessimistic scenario and assign a 15 percent probability to a more optimistic scenario.

This new update tells us that not much has changed since the February forecast. However, there’s still need for caution this legislative session. As we’ve written before, there’s still considerable uncertainty around the economy and federal funding.

This is the last quarterly revenue update that policymakers will get before the legislative session ends in May. As they work toward the tax and budget decisions they will enact this year, they should be mindful of the considerable uncertainty of these times, and seek to strengthen the state’s ability to sustain support for our schools, families, and communities.

-Clark Goldenrod