The U.S. Senate is currently considering a tax bill that would provide the largest tax benefits to those already doing well in today’s economy. As we’ve explored in prior blogs, the Republican plans provide small and shrinking tax benefits for lower- and middle-income families, and many would actually see tax increases. Senate leadership has lifted up their Child Tax Credit (CTC) expansion as their signature benefit for working families. However, an analysis from the Center on Budget and Policy Priorities shows that many families would be left out of the CTC expansion, and many immigrant families would see their tax credits completely eliminated. And the expansion is temporary, expiring after 2025.

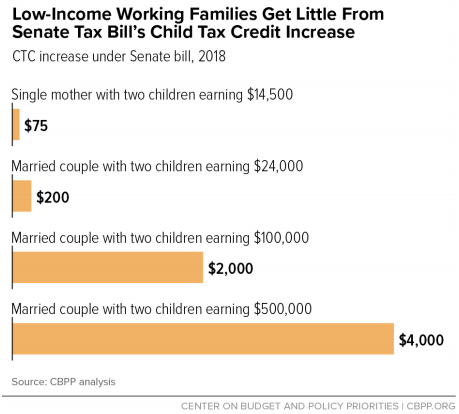

The Senate tax bill doubles the maximum CTC that families can qualify for to $2,000 per child. It also extends the credit for the first time to high-income households – for example, married couples with two children and incomes between $150,000 and $580,000 would become newly eligible. It’s high-income families who see the largest benefits, while working-class families see only a small increase. This is because the CTC is not fully available to families who have incomes below a certain level, and the proposal on the table does little to fix this. Many of these parents receiving a less than a full increase are working to make ends meet in sales, food preparation or administrative support jobs. Additionally, about 1 in 7 of all U.S. children living in working families would only receive a token increase of $75 or less from the proposal; 1.1 million of these children are living in deep poverty. In Minnesota, 134,000 children live in working families that would receive only a small increase; about one-quarter of those children live in rural counties.

The Child Tax Credit proposal also takes the credit away from about 1 million children across the country. Currently, many immigrant workers who do not have a Social Security Number (SSN) use what’s called an ITIN to file their taxes. Workers filing with an ITIN are generally subject to the same tax rules as those filing with an SSN and are also eligible for the Child Tax Credit. However, the Senate would eliminate the credit for children without an SSN. Almost all of the children affected are Dreamers, children who came to the United States at a very early age and who often know no other country as their home.

The Child Tax Credit proposal also takes the credit away from about 1 million children across the country. Currently, many immigrant workers who do not have a Social Security Number (SSN) use what’s called an ITIN to file their taxes. Workers filing with an ITIN are generally subject to the same tax rules as those filing with an SSN and are also eligible for the Child Tax Credit. However, the Senate would eliminate the credit for children without an SSN. Almost all of the children affected are Dreamers, children who came to the United States at a very early age and who often know no other country as their home.

As in many states across the country, with a tightening labor market and a projected labor shortage on the horizon, Minnesota’s economic growth increasingly depends on adding more people to our workforce. We will increasingly rely on immigrants and refugees to fill vital roles as employees, business owners, and entrepreneurs. In addition, income supports like refundable tax credits are linked to better school performance and higher college enrollment. But taking away the Child Tax Credit would not only increase hardship immediately for these families, it would also make it less likely that these immigrant children will be able to reach their full potential in school and later in the workforce.

The Child Tax Credit expansion, while touted as a boon for low- and middle-income families, actually does little to make our tax system work better for folks working to make ends meet. Furthermore, the proposed improvements to the credit cannot overcome the Senate tax bill’s overall problems. Its benefits still primarily go to the highest-income households and profitable corporations, and the plan would increase the deficit by more than $1 trillion over the next decade, which will almost certainly lead to cuts to health care and other essential services.

-Clark Goldenrod