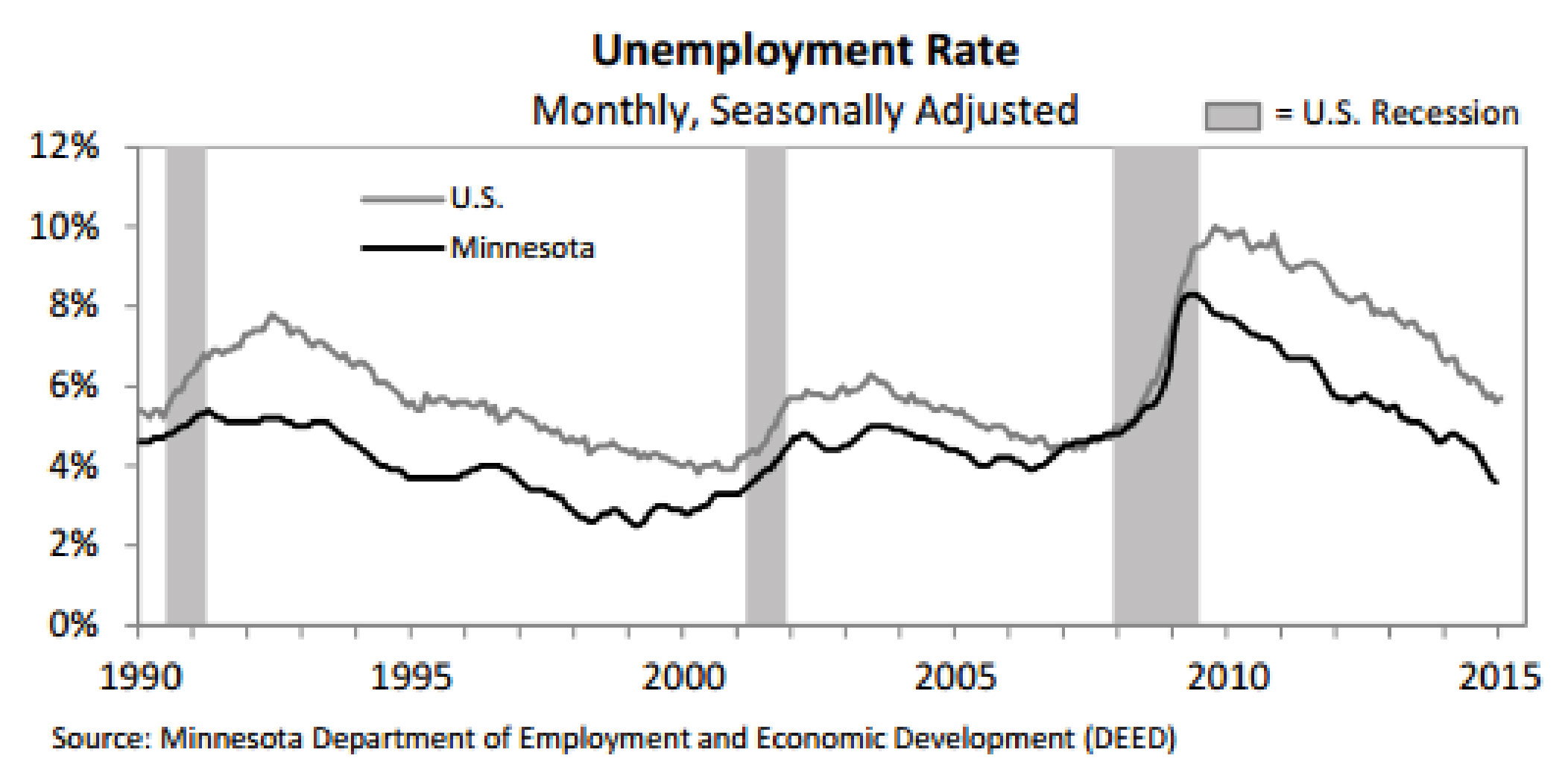

The forecast shows that Minnesota’s economy is improving. In December, unemployment in Minnesota was 3.6 percent, the fifth lowest in the nation and the lowest rate since 2001. As in the November forecast, this recent unemployment improvement included those hit hardest by the recession. Even though unemployment rates remain higher for people of color, single parents and young people, the recent drops in unemployment were felt by workers across race, gender and age.[2]

Minnesota’s growing economy has contributed to a stronger financial situation for the state. The forecast projects a $478 million positive balance in the current budget cycle. The forecast assumes this balance will be carried forward into the next biennium, which contributes to the projected $1.9 billion positive balance for FY 2016-17. However, taking the impact of inflation on expenditures into account would decrease the positive balance to $976 million.

This forecast also gives us a glimpse into the FY 2018-19 biennium, where Minnesota has a projected $3.2 billion structural balance. However, when the impact of inflation on expenditures is included, this becomes a slight deficit of $95 million. In other words, to the extent that policymakers use the positive balance for tax cuts or new spending, current services will fail to keep up with the cost of inflation.

The state's economic forecasts are a critical tool that policymakers and the public use to measure the state's fiscal health, and they form the baseline against which to assess spending and tax proposals. Minnesota Management and Budget prepares forecasts each November and February. State, national and global economic trends are used to estimate Minnesota's future revenues and expenditures under current laws.

Good information is needed to determine whether tax and budget decisions are sustainable. But for more than a decade, the official forecast figures have not included the cost to adjust most spending items for inflation. The state's Council of Economic Advisors has recommended that Minnesota include inflation in its planning estimates so that they provide a more useful guide to policymaking.

Positive Balances due to Higher Revenues, Lower Spending

The positive balance in the February forecast is due to a few factors. Revenues are projected to come in higher than expected. The strongest driver is higher income tax collections. Much of this is due to expected rising incomes and capital gains realizations.

The forecast also shows lower projected expenditures. In the 2014-15 biennium, this is due in part to lower-than-anticipated Medical Assistance spending. In the 2016-17 biennium, lower projected spending in E-12 education contributes to the positive projected balance. The lower projected E-12 spending is a result of declines in three areas: student enrollment, growth of poverty concentration (which is used to calculate compensatory aid for schools), and special education spending.

U.S. Economy Expected to Improve

The national economy is recovering. Unemployment continues to fall, and higher household purchasing power is encouraging consumer confidence. The forecast predicts 3.0 percent growth in national GDP in 2015, up from 2.6 percent growth predicted in the November forecast. Growth in 2016 and 2017 is expected to be 2.7 and 2.8 percent respectively, just slightly lower than the November projections.

The forecast notes that declining oil prices and the value of the dollar are both shaping our economy. Both are driving down inflation but affecting economic growth in different ways, which largely cancel each other out. Cheaper gas frees up more income for other household needs, but it also means less investment in domestic energy production. Overall, since the U.S. primarily relies on imported energy, cheaper gas is expected to have a positive effect on the economy. The strong U.S. dollar is expected to drive up the price for U.S. exports and lower the price of foreign goods for U.S. consumers. This widens the trade imbalance, which is projected to negate much of the economic benefits of lower oil prices.

Forecasters assign a 70 percent probability that this baseline economic forecast will be accurate. They assign a 15 percent chance to a more pessimistic scenario where the U.S. economy stalls due to a weaker housing market and weaker foreign growth. They also assign a 15 percent probability to a more optimistic scenario where the U.S. economy does better than projected as oil prices drop more than expected and foreign growth is higher than anticipated.

Policymakers Should Continue to Expand Opportunity for Minnesotans

The state has turned the corner after a decade of frequent deficits, and is now on firmer financial footing. However, even as the state's economy has improved, many Minnesotans still struggle to make ends meet. The projected positive balances outlined in the February forecast allow the state to invest in a future of opportunity for all Minnesotans.

A substantial barrier to economic success facing many Minnesota families is the high cost of child care. More than 5,500 Minnesota families are on waiting lists for Basic Sliding Fee Child Care Assistance, which helps working families afford the care that meets their needs. Additional funding for Basic Sliding Fee would mean more parents can get to work, more children can spend their days in a stable environment, and more employers can more easily retain the workers they need.

Governor Mark Dayton has shown his commitment to making affordable child care assistance available to more Minnesota families by proposing to increase funding for Basic Sliding Fee and expand the Child and Dependent Care Tax Credit in his budget. Legislators from both parties have gone a step further by proposing bills with larger increases to Basic Sliding Fee to reach more families, including all of the current waiting list, and protect parent choice by increasing reimbursement rates for child care providers.[3] These bills represent a smart investment in our current and future workforce, and should be a priority for policymakers this session.

The tax policy choices made in the past two years made important progress making our tax system more fair. Minnesota has shrunk the gap between what most Minnesotans pay in state and local taxes (measured as a share of their incomes) and the smaller percentage that those with the highest incomes pay. However, too many of the tax bills proposed this session so far would re-open that gap through tax cuts that would primarily go to those with the highest incomes.

Policymakers should resist large tax cuts that significantly reduce state revenues and threaten the state's ability to fund critical services. History shows that when policymakers have gone too far in tax cutting in good times, it makes the state's challenges more serious during the next economic downturn. Any tax cuts passed in 2015 should be limited in size and have making our tax system fairer as a goal.

The February forecast brought our state some good news. But the economic recovery has not yet reached all Minnesotans. As policymakers set the next two-year budget, they should continue efforts to invest in a future of shared prosperity.

By Clark Biegler