Minnesota faces a long, slow economic recovery, large state deficits and some very tough choices. Taking a balanced approach, including raising revenues, would allow the state to maintain core investments in education, health care, job training and other services that help Minnesotans still struggling with the slow recovery and best position the state for when prosperity returns.

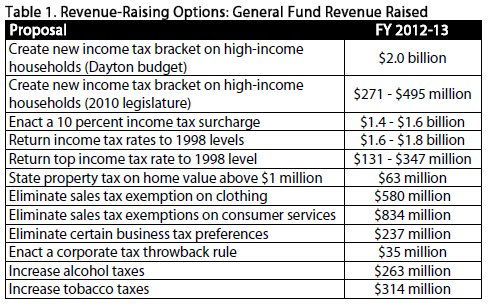

The following analysis presents several revenue-raising proposals that have been part of the public discussion. It does not represent a complete tax reform package, but rather a menu of choices that could become part of a budget-balancing plan.[1]

Policymakers are considering state tax reform at a time when Minnesota tax revenues are a smaller share of the state’s economy than a decade ago. The average share of their household incomes that Minnesotans pay in state and local taxes dropped by 11 percent from 1996 to 2008.[2] This decline should come as no surprise, considering that Minnesota made the largest tax cuts in the country in 1997, 1999 and 2001.[3]

Policymakers also have the opportunity to reverse the trend of rising regressivity in Minnesota’s tax system. That trend has shifted more responsibility for funding state and local services onto low- and moderate-income Minnesotans. In particular, the wealthiest one percent of Minnesota households — those with incomes over $429,000 — paid 9.7 percent of their incomes in total state and local taxes in 2008, compared to the statewide average of 11.5 percent.[4]

Income Tax Changes

The income tax is the state tax that relates the most to the ability to pay. Recent proposals to increase the income tax would increase the degree of fairness of Minnesota’s state and local tax system.

There have been several proposals to create a new income tax bracket for high-income Minnesotans. They are often referred to as “fourth tier” proposals, as they add a new income tax bracket on top of the state’s three existing brackets.

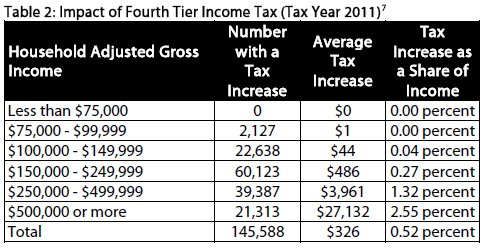

In his FY 2012-13 budget, Governor Mark Dayton proposes a new 10.95 percent tax bracket for taxable income above $150,000 a year for a married couple.[5] This proposal would raise $2.0 billion in FY 2012-13, and impact 5.8 percent of filers.[6]

The Governor’s budget notes that, when the ability to deduct state taxes from one’s federal income tax is taken into account, the average tax increase and tax increase as a share of income under this proposal is likely to decrease. For example, for households with incomes above $500,000, their average tax increase as a share of income drops from 2.55 percent to 2.0 when federal deductibility is taken into account.

Questions have been raised about the potential impact of a fourth tier income tax on small businesses. It is difficult to know the impact on small businesses per se, but there is data on “pass-through” income, which is the kind of business income that shows up on the individual income tax. Department of Revenue analysis finds that only 11 percent of tax returns with pass-through income would be impacted by the proposed fourth tier.[8]

Fourth tier proposals have been passed by the legislature several times in recent years, and were vetoed by Governor Pawlenty. For example, in 2010, the legislature passed a 9.1 rate on taxable income above $200,000 for a married couple. Were the state to pass such a proposal today, it would raise $271 to $495 million in FY 2012-13.[9]

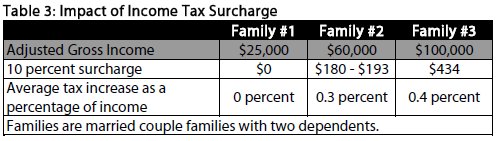

A second possible approach to raise revenue through the income tax is to institute an income tax surcharge. This is a fairly simple way to raise revenue: income taxes are calculated following the existing tax laws, but then an additional surcharge is added. A surcharge could also be removed, or “blinked off”, when the additional revenue is no longer needed. The state last used a surcharge to address deficits in the early 1980s.

A 10 percent income tax surcharge would raise $1.4 to $1.6 billion in FY 2012-13.[10] Minnesota’s income tax is based on ability to pay, and so is an income tax surcharge. As shown in Table 3, high-income households would see larger tax increases under a surcharge, while the impact on low- to moderate-income Minnesotans would be relatively modest or even zero.[11]

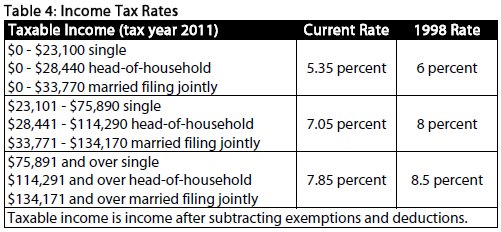

In 2009, the Senate omnibus tax bill rolled back the state’s income tax rates to their 1998 levels, prior to cuts passed in the 1999 and 2000 Legislative Sessions. (It did not become law.) Were it passed this session, this option would raise $1.6 to $1.8 billion in FY 2012-13.[12] Table 4 compares current rates to 1998 rates.[13]

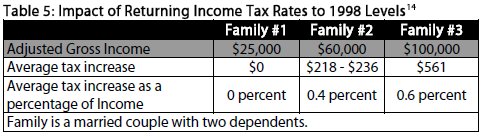

Table 5 shows how a rollback proposal would affect example households. A married couple with two children and an adjusted gross income of $25,000 could expect to see no tax increase. That same family with an adjusted gross income of $100,000 would see a tax increase of $561. For all example families, the average tax increase would be less than one percent of the household’s income.

As an alternative, policymakers could choose to return only the top income tax rate to its 1998 level. This more targeted tax increase would raise $131 to $347 million in FY 2012-13.[15]

State Property Taxes

Property taxes are primarily a local revenue source, but there is a statewide property tax paid by businesses and cabins. Governor Dayton proposes to add home values over $1 million to the statewide property tax, raising $63 million in FY 2012-13 and $85 million in FY 2014-15.[16] The property tax would apply only to the amount of a home’s value over $1 million. This proposal is estimated to impact 7,800 properties with values over $1 million, with an average tax increase of $5,600.[17]

Sales Tax Modernization

Currently, Minnesotans pay sales tax on most goods but pay no sales tax when they purchase most services, even as services have become a larger share of the economy.[18] There has been some discussion of expanding the sales tax base to include more services, but also to some currently exempt goods.

Two of many options for sales tax base broadening are:

- Eliminating the exemption on clothing, which would raise $580 million in FY 2012-13.[19]

- Eliminating exemptions on consumer purchases of many services, which would raise $834 million in FY 2012-13.[20]

The first option simply applies the sales tax to one exempt category: clothing. Minnesota is one of five states with a sales tax that exempts most clothing.[21]

The second option takes a different approach and would tax a range of consumer purchases of services, including: car repair and maintenance, personal care services (such as hair styling and body piercing), legal services, accounting services and funeral services.

The proposal would not tax business-to-business services, following the argument that sales tax should be paid on final consumption, not on business inputs. Taxing services purchased by businesses would raise an estimated $4.4 billion in FY 2012-13.[22]

Eliminate Certain Business Tax Preferences

In recent years, policymakers have taken a look at tax expenditures across the range of tax types. In the corporate tax area, this discussion has often focused on eliminating tax preferences that provide benefits for only certain kinds of businesses.

Governor Dayton’s budget would repeal two such tax preferences, raising $237 million in FY 2012-13.[23] These are:

- Ending the current Foreign Royalty exclusion, which exempts from taxation any royalty payments a multinational corporation receives from its foreign subsidiaries.

- Repealing the special tax treatment of Foreign Operating Corporations (FOCs). FOCs are parts of a multinational corporation that are incorporated in the U.S. but at least 80 percent of their income is from foreign sources. This foreign income currently is taxed at an 80 percent discount. The bill would treat this income the same as domestically-produced income.

These provisions were included in House File 3044 and Senate File 2893 in the 2010 Legislative Session, and similar provisions were passed as part of the House of Representatives’ omnibus tax bill in 2009.

An additional policy that Minnesota could adopt is a “throwback rule.” Corporations that sell their products in more than one state must meet a certain threshold of presence in Minnesota before their profits are subject to the state’s corporate income tax. Because of this threshold, some corporate income becomes “nowhere income,” or profit that is not taxed in any of the 50 states.[24]

A throwback rule would allow Minnesota to tax corporate profits of Minnesota-based companies that otherwise would not be taxed in any state. Sales made to a state in which a corporation is not taxed would be treated as if they were made to customers in Minnesota. Of the 45 states with corporate income taxes, 25 have a throwback rule. A throwback rule in Minnesota would raise an estimated $35 million in FY 2012-13.[25]

Increase Alcohol Taxes

Minnesota has two alcohol taxes: an excise tax on manufacturers and wholesalers and a gross receipts tax for retail sales, both on-sale and off-sale purchases.[26] The Minnesota Legislature’s 2009 omnibus tax bill increased the alcohol gross receipts tax from 2.5 percent to 5.0 percent, and increased the alcoholic beverage excise tax by about two cents a drink for beer and wine and about three cents a drink for distilled spirits. Governor Pawlenty vetoed the legislation and it did not become law. Passing that law today would raise $263 million in FY 2012-13.[27]

Alcoholic beverage excise taxes are set at a certain number of cents per unit. In that way they differ from the general sales tax, which is a percentage of the sales price. As a result, alcohol excise taxes do not automatically increase as prices rise with inflation. Alcoholic beverage excise taxes have not been raised since 1987.[28] Some have advocated for alcohol tax increases as an “impact fee,” because of the health and public safety costs the state pays for alcohol abuse.

Increasing Tobacco Taxes

Minnesota has several taxes and fees on cigarettes and other tobacco products. Minnesota charges a 48 cents per pack cigarette excise tax and a 75 per pack health impact fee, or $1.23 per pack total. There is additional tax in lieu of a sales tax, as well as an added fee on those cigarette companies that were not part of the tobacco lawsuit settlement.[29]

In 2009, House File 2194 proposed raising the cigarette tax by $1 per pack and doubling the separate tobacco products tax from 35 percent to 70 percent. It would raise $314 million in FY 2012-13.[30]

Creating a Balanced Package Can Ensure that Revenue-Raising Also Addresses Tax Fairness

Whatever revenue increases are chosen, policymakers should pay attention to tax fairness. Minnesota’s tax system has shifted more responsibility for funding public services to low- and middle-income Minnesotans, due to cuts in the progressive income tax at the end of the 1990s, combined with economic trends and more recent increases in regressive property, tobacco and sales taxes.

Most state and local taxes are regressive, with the income tax being the major exception. That does not mean that all regressive taxes should be off the table. Instead, the focus should be on creating a package of revenue-raisers that overall improves tax fairness. Strategies to ensure a fair revenue-raising package include:

- Ensuring that a progressive income tax increase is part of the overall tax package, and that it is large enough so that the total tax package is not regressive.

- Expanding and maintaining existing refundable tax credits for low-income families, such as the Working Family Credit and Property Tax Refund, or creating new tax refunds or credits that target assistance based on income. If significant expansion of the sales tax is considered, another option would be to create an automatic sales tax credit, similar to the sales tax rebate used during the surplus years, but targeted to people with low or moderate income.

Minnesota Should Take a Balanced Approach

The economy is in a tenuous recovery and the state budget again faces huge shortfalls. Minnesota policymakers will need to use a balanced approach and draw on all of the tools in their budget-balancing toolbox to fix our deficits.

It makes sense to use revenue increases as part of the budget deficit solution. Nobel Prize-winning economist Joseph Stiglitz and former Office of Management and Budget director Peter Orszag have written that state spending cuts can hurt the economy more during an economic downturn than tax increases.[31] When government spending is cut, money is taken out of the state’s economy. The state spends less on employee wages and the purchase of goods and services, money that would otherwise circulate in the economy. In contrast, a tax increase on high-income households is likely to create less economic drag. Residents who are better off are likely to maintain their spending and compensate by saving less.

A balanced approach – one that includes increases in revenues – would enable the state to maintain the vital services that are critical for the long-term health of our communities and our state. This is the approach that a majority of states have taken to respond to the budget challenges created by the economic crisis.[32]

The economic crisis also provides policymakers with an opportunity to reverse the trend of rising regressivity.