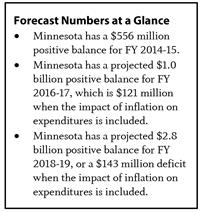

As shown in the state’s November 2014 Economic Forecast, Minnesota continues to be in positive budget territory, with a $556 million positive balance for the remainder of the current two-year budget cycle, FY 2014-15.[1] Minnesota also has a projected positive balance for the upcoming FY 2016-17 budget cycle of $1.0 billion. The state’s economy is improving and performing better than the U.S. economy, although growth is expected to be slower than originally projected.

In the 2015 Legislative Session, policymakers will set the budget for the upcoming FY 2016-17 biennium. The positive balances projected in the forecast provide an opportunity for Minnesota to continue on its recent path of making smart investments that promote broader economic security and make our tax system fairer. But policymakers must make sustainable choices, and avoid deep tax cuts that would put the state’s ability to fund crucial services at risk.

Minnesota Forecast to Have Positive Balances

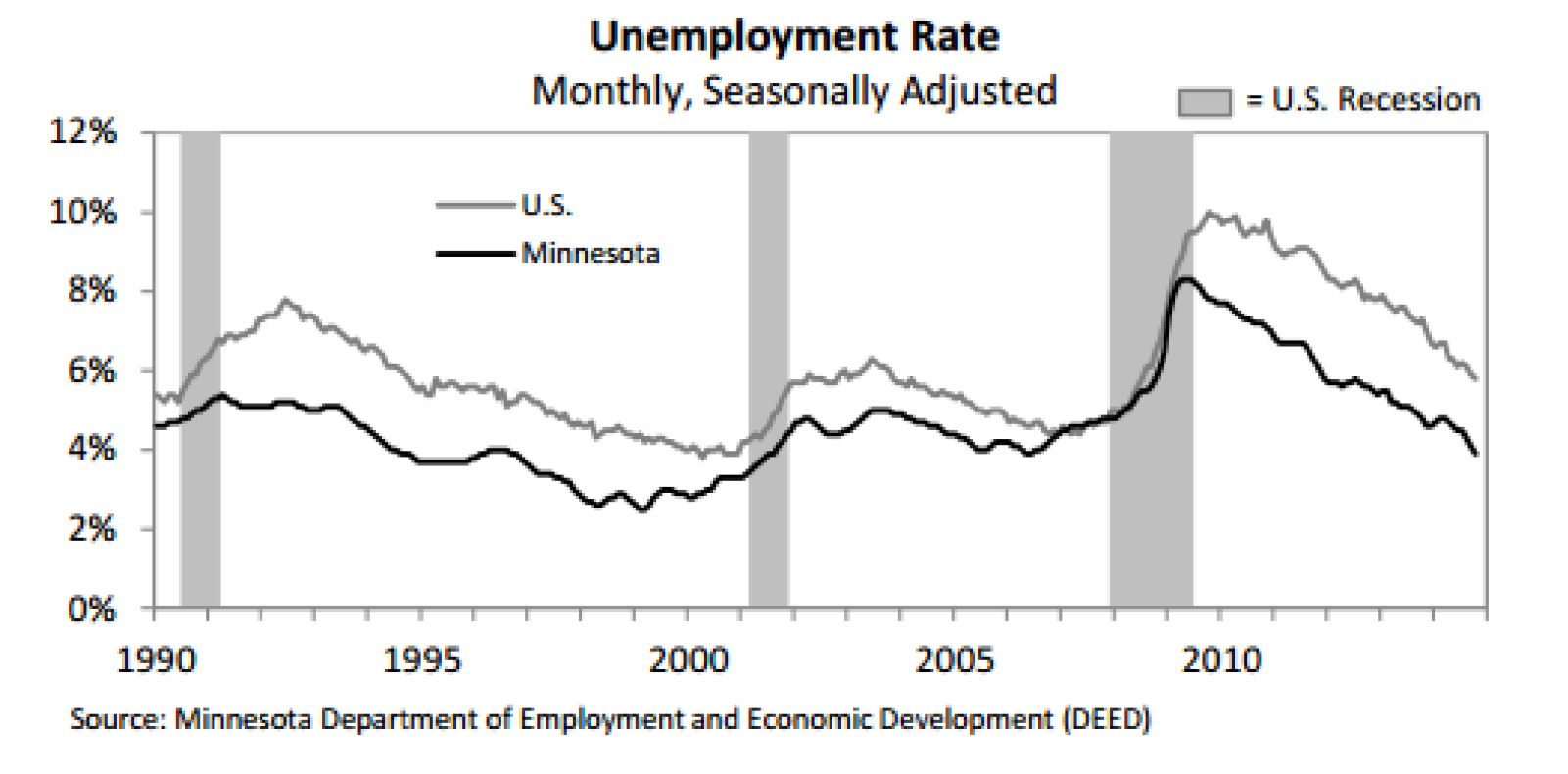

The forecast shows that Minnesota’s economy is improving. In October, unemployment in Minnesota was 3.9 percent, the fifth lowest in the nation. This recent unemployment improvement included those hit hardest by the recession. Even though unemployment remains higher for people of color, single parents and young people, the recent improvements were felt by workers across race, gender and age.[2] While this is welcome news, Minnesota’s future growth projections are lower than earlier expectations.

Minnesota’s economy has contributed to a stronger financial situation for the state. The forecast projects a $556 million positive balance in the current budget cycle. Part of this balance has been transferred to the budget reserve. The forecast assumes the remainder will be carried forward into the next biennium, and contributes to the projected $1.0 billion positive balance for FY 2016-17. However, taking the impact of inflation on expenditures into account would decrease the positive balance to $121 million. In other words, to the extent that policymakers use the positive balance for tax cuts or new spending, current services will fail to keep up with the cost of inflation.

A policy change passed last year requires that up to one-third of a positive balance in a November forecast goes to the state’s budget reserve. This means that $183 million of the FY 2014-15 balance has been added to the reserve, bringing it to $994 million. Including the cash flow account, total general fund reserves are now at $1.3 billion. However, current reserves still fall below recommendations. Minnesota Management and Budget currently recommends reserves of $1.9 billion in order for the state to be well prepared for the next economic downturn.[3]

This forecast also gives us a first glimpse of the FY 2018-19 biennium, where Minnesota has a projected $2.8 billion structural balance. However, when the impact of inflation on expenditures is included, this becomes a slight deficit of $143 million.

The state’s economic forecasts are a critical tool that policymakers and the public use to measure the state’s fiscal health, and they form the baseline against which to assess spending and tax proposals. Minnesota Management and Budget prepares forecasts each November and February. State, national and global economic trends are used to estimate Minnesota’s future revenues and expenditures under current laws on taxes and spending.

Good information is needed to determine whether tax and budget decisions are sustainable. But for more than a decade, the official forecast figures have not included the cost to adjust most spending items for inflation. The state’s Council of Economic Advisors has recommended that Minnesota include inflation in its planning estimates so that they provide a more useful guide to policymaking.

Positive Balances due to Higher Revenues this Biennium, Lower Spending

The positive balance in the November forecast is due to a few factors. For FY 2014-15, revenues are coming in higher than expected, primarily in the income tax, and spending is projected to be lower. While estimated revenues for FY 2016-17 are now expected to be lower than previous estimates, this is offset by lower anticipated spending.

The largest driver of the lower spending is a drop in Medical Assistance costs as a result of changes in the projected caseload. Overall enrollment is expected to stay the same, but with a different mix. Fewer children and families, elderly people and people with disabilities are expected to participate in Medical Assistance, which results in a cost savings. More childless adults are enrolling in Medical Assistance, but this adds no additional cost to the state, as the federal government fully funds health care for these Minnesotans until 2017, and covers most of the cost after that.

Economic Improvement Expected, But Not Guaranteed

The national economy is recovering, and the forecast predicts 2.6 percent growth in GDP next year. However, this is lower growth than in previous projections, in part due to lower wage growth and slower housing starts.

Forecasters assign a 70 percent probability that this baseline economic forecast will be accurate. However, the forecast advises that the picture could change. Forecasters assign a 15 percent chance to a more pessimistic scenario where the U.S. barely avoids a recession due to a weaker housing market. They also assign a 15 percent probability to a more optimistic scenario where oil prices drop more than expected and foreign growth is higher than anticipated.

2015 Session is an Opportunity for Future Progress

Over the past few years, policymakers have made important progress on raising enough revenues to end the cycle of frequent budget deficits, and on making the tax system more based on the taxpayers’ ability to pay.

The state also made new investments for a more prosperous future, such as expanding free all-day kindergarten and freezing tuition at public colleges and universities. As policymakers decide what to do with the projected positive balances outlined in the November forecast, they should continue to make targeted investments in a future of opportunity for all Minnesotans, including those who have been left behind in the economic recovery.

A substantial challenge facing many Minnesota families is finding child care that meets their needs. Lack of affordable child care makes it difficult for some parents to go to work, and can make it hard for employers to attract the employees they need. The state should invest in reliable, affordable child care, including by increasing funding for Basic Sliding Fee child care assistance and expanding the dependent care tax credit for low- and moderate-income Minnesotans.

Policymakers should resist large tax cuts that significantly reduce state revenues and threaten the state’s ability to fund critical services. History shows that when policymakers have gone too far in tax cutting in good times, it makes the state’s challenges more serious during the next economic downturn. Any tax cuts passed in 2015 should be limited in size and focused on making our tax system fairer.

The November forecast brought our state some good news. But the economic recovery has not yet reached all Minnesotans. As policymakers set the next two-year budget, they should continue efforts to invest in a future of shared prosperity.

By Clark Biegler