The November 2013 Economic Forecast brought some good news for the state. With a $1.1 billion positive balance, Minnesota will be able to finish reversing past budget gimmicks. The state’s economy is also faring much better than the overall U.S. economy. However, we’re only a few months into the current biennium. These numbers could weaken in future forecasts since the overall U.S. economy remains fragile.[1]

In the 2013 Legislative Session, policymakers passed a budget that raised new revenues, made our tax system more fair, and made crucial investments in our future. Policymakers should use the positive balance to maintain this course and also prepare for future economic downturns by building up budget reserves.

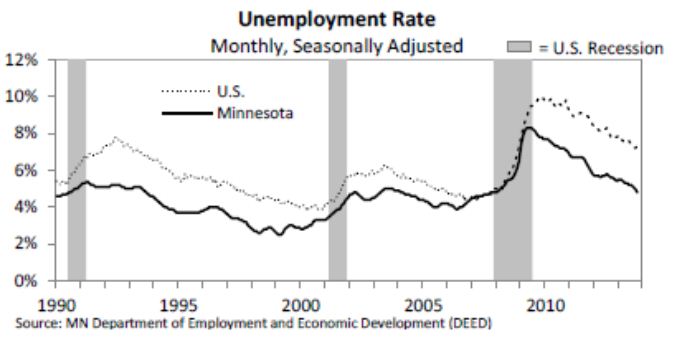

The state’s job picture continues to improve. Unemployment is falling and claims for jobless benefits are at the lowest level in a decade. Minnesota’s economy has outperformed the national economy, which contributes to higher projected revenues. That additional revenue, coupled with reductions in anticipated spending, results in the projected $1.1 billion positive balance in the current budget cycle, the FY 2014-15 biennium.

This positive balance allows Minnesota to completely reverse the rest of the school funding shifts and repay a transfer from the state airports fund, two actions used to address past budget shortfalls. The state has a $825 million positive balance for FY 2014-15 after these payments.

And the good news continues into the next biennium. The forecast projects a $2.2 billion positive balance for the FY 2016-17 budget cycle. Taking the impact of inflation on expenditures into account would decrease the positive balance to $1.0 billion.

The state’s economic forecasts are a critical tool that the Governor and Legislature use to measure the state’s fiscal health and assess spending and tax proposals. Minnesota Management and Budget prepares forecasts each November and February. State, national and global economic trends are used to estimate Minnesota’s future revenues and expenditures under current laws on taxes and spending.

Higher Revenues and Lower Spending Create a Positive Balance

The strong positive balance of $1.1 billion in the current budget cycle comes from higher revenues and lower spending. The additional revenues come primarily from higher income, corporate and sales tax collections than were expected at the end of the 2013 Legislative Session in May. On the spending side, the savings are primarily due to lower than anticipated Medicaid spending.

The positive balance means that Minnesota will fully reverse the school funding shifts that were used in prior years to balance the budget. These shifts will be paid off with $246 million of the balance. A smaller amount ($15 million) will go toward refilling the state airports fund, as required by law.

For the first time in several forecasts, the state has both short term and long term good news. The positive balance extends into the FY 2016-17 budget cycle, when Minnesota is projected to have a $2.2 billion positive balance. Even after accounting for the impact of inflation on expenditures, the state will have a $1.0 billion positive balance.

Federal Uncertainty a Risk for Minnesota

The national economy is recovering, and the forecast predicts the U.S. economy will grow faster next year, with 2.5 percent growth in GDP. State forecasters assign a 60 percent probability to this baseline economic forecast. Alternatively, forecasters assign a 20 percent chance to a more pessimistic scenario where there is “unwarranted fiscal tightening” at the federal level and a worsening global economic crisis, barely avoiding another recession next year. They also assign a 20 percent probability to a more optimistic scenario where federal policymakers enact a “credible long term deficit reduction plan” instead of the sequester’s automatic spending cuts.

Passage of the federal budget deal in December that lessens some of the sequester for the next two years suggests the pessimistic scenario may be less likely.

Minnesota is on a Better Track

Tax and budget decisions in the 2013 Legislative Session made important progress on raising enough revenues to meet our spending commitments, making targeted new investments in a more prosperous future, and basing our tax system more on income. In 2014, policymakers should maintain this improved course while also preparing for future economic downturns.

Policymakers should resist tax cuts that significantly reduce state revenues and threaten our ability to invest in quality schools, affordable education and training opportunities, and other components of economic success. While the 2013 tax bill made significant progress on tax fairness, many low-income Minnesotans still pay a higher share of their incomes in taxes than those with the highest incomes. Updating the state’s Working Family Tax Credit to adopt recent federal improvements would be a good additional step to ensure that low- and moderate-income Minnesotans aren’t paying more than their fair share to support public services.

The state’s strong economic performance creates the opportunity to strengthen our budget reserves to prepare for the next downturn in the business cycle. Adequate reserves give policymakers the ability to soften the shock of future budget shortfalls. The state’s Council of Economic Advisors has long recommended reserves equal to 5 percent of the state’s general fund biennial budget – that’s $1.9 billion for the FY 2014-15 biennium. With budget reserves at $656 million and a cash flow account of $350 million, the state falls far short of this figure.

The November forecast brought our state some good news, but policymakers need to act cautiously. They should keep revenues strong, continue efforts for a fair tax system, and strengthen state budget reserves to make sure Minnesota stays on a solid track.

By Caitlin Biegler