COVID-19 is still a major threat to the country’s health, economy, and public services we all count on. The state of Minnesota’s recent

October Revenue and Economic Update offered a better picture compared to the

May budget projection, but some of that improvement is dependent on federal policymakers quickly taking action

on needed economic support for struggling families.

Some of the top takeaways from the Update include:

1.

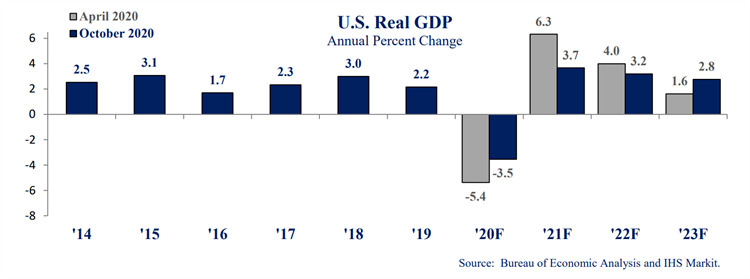

The economic picture has somewhat improved … but there’s a big “if”. The economic forecasters now predict a 3.5 percent reduction in the nation’s GDP in 2020, compared to a 5.4 percent drop projected a few months ago. That projection is based on the assumption that Congress will enact COVID-19 relief/economic stimulus legislation that takes effect this year (more about that below). While forecasters still expect economic growth to resume in 2021, they’ve significantly lowered that projection to only 3.7 percent growth next year, much weaker growth than in earlier projections.

2.

State revenues to-date came in higher compared to the May budget projection. Revenues for July to September this year came in $593 million – 12.7 percent -- higher than the earlier projection. Some of this higher-than-expected revenue is likely due to timing shifts in income tax payments. Sales taxes were the largest contributor to the increased revenues and seem to reflect actual higher sales than expected, although sales tax revenues are still 3.8 percent lower than a year ago. Corporate tax revenues were both higher than the May projection and 16.8 percent higher than a year ago. While these higher revenues are good news, they are not enough to reverse the huge drop in state revenues that contributed to the $2.4 billion state budget shortfall for FY 2020-21 estimated in May.

3.

Unemployment is expected to remain high. In September, the national unemployment rate was 7.9 percent, down from the peak of 14.7 percent in April. IHS, the state’s economic forecasters, expect unemployment to remain above 8 percent until late in the year, and don’t expect it to return to pre-COVID levels until 2024. The report notes that while the unemployment rate has declined, it doesn’t capture those who have left the labor force during the pandemic – for example, workers who have stopped looking for work right now. The labor force participation rate is about 2 percentage points lower than it was a year ago.

4.

Forecasters are only somewhat confident in their projections. The nation’s economic performance is dependent on the severity of the pandemic and the effectiveness of efforts to bring it under control. Uncertainty about the course of the pandemic is reflected in forecasters’ uncertainty about their projections. They assign a 50 percent chance that their baseline economic scenario is correct, and give a 30 percent chance for a more pessimistic scenario that includes an increase in COVID-19 cases and a slower recovery. They assign a 20 percent probability to a more optimistic scenario in which the impact of COVID-19 is less severe.

This latest economic update demonstrates the ongoing need for policymakers to respond to the nation’s health, economic, and state budget crises. Importantly, the improved economic picture is contingent in part upon federal policymakers funding emergency unemployment supports through December and sending another round of stimulus checks. However, the timeline for Congress and the White House to reach an agreement for a much-needed federal COVID-19 stimulus bill is unclear, and continued delay is making the economic picture much harsher, leaving millions of Americans and their families without the economic supports they need right now and delaying the recovery.

Additionally, failure to act quickly at the federal level means that state, local, and tribal governments are not receiving the financial supports they need to ensure that Minnesotans can stay healthy and keep a roof over their head. The state’s

July economic update noted the economic drag created by state and local government budget cuts, adding, “Without additional federal support, state and local governments face substantial revenue shortfalls in the coming fiscal years.”

This is a time that truly requires policymakers to

draw on the resources needed, including judicious use of the budget reserve and raising state revenues. The latest state economic update underscores that additional federal supports are a crucial piece for both individuals and families and state and local governments having what they need to weather this crisis.