The recently released October Revenue and Economic Update gave us some improved news about the state’s economic and budget landscape. The quarterly report from Minnesota Management and Budget (MMB) showed that state revenues for the past several months have come in above expectations. It also reported that the national economy is expected to continue to grow at a fair pace this year. However, that growth is expected to taper off over the next few years, and the state's economic forecasters note a higher chance that a more pessimistic scenario for the economy will play out.

Some of the top takeaways from the Update include:

1. State revenues have come in above projections. Revenues for the first quarter of FY 2020 (July to September of this year) came in $217 million above projections; that’s 4.4 percent more than projected in the state’s February 2019 Economic Forecast. MMB believes this increase is primarily the result of the timing of income taxes, and not increased economic activity.

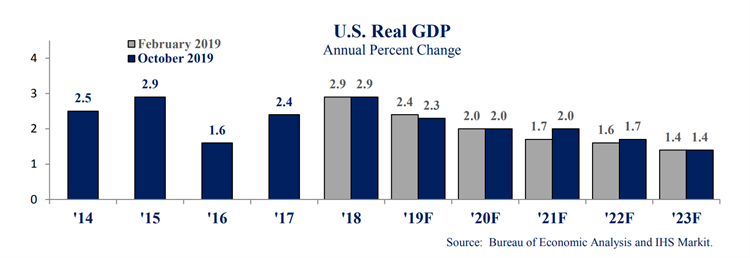

2. Long-term economic growth is still expected to be low, but is somewhat improved over prior estimates. The national economic forecasters have decreased their predictions for national GDP growth for 2019, from the 2.4 percent predicted in February to 2.3 percent in the October Update. For the next few years, while they still expect growth to taper off, they are more optimistic about the level of growth than before. Growth estimates for 2021 and 2022 are expected to be 2.0 percent and 1.7 percent respectively, an improvement over the estimates from the February forecast. These higher growth estimates are predicated on stronger expected consumer spending.

3. Unemployment is expected to remain low. Nationally, unemployment was 3.5 percent in September, its lowest point since December of 1969. The state's economic consultant expects this rate to be the lowest that unemployment reaches during this business cycle, with the unemployment rate starting to rise slightly in 2021.

4. Forecasters are somewhat confident in their projections. The forecasters are less certain about their baseline economic scenario than they were in February. They assign a 55 percent chance that their baseline forecast is correct. They also give a 35 percent chance for a more pessimistic scenario in which there’s a recession starting next year, and assign a 10 percent probability to a more optimistic scenario. This reflects greater uncertainty than in February, when forecasters gave the baseline projection a 60 percent probability and the pessimistic scenario a 25 percent probability.

This month's Update brought us good short-term news: revenues are up, and the economy is growing at a good pace for now. However, we know from other data, such as recent releases from the U.S. Census Bureau, that these numbers mask the fact that economic growth by itself is not enough to bring about broad prosperity, and many in Minnesota are not sharing in the benefits of today's economy. The state's next legislative session starts in February 2020, just four months from now. Policymakers should take the opportunity next session to advance policies so that more Minnesotans can thrive in today's economy, no matter who they are or where they live.

We estimated that the budget that policymakers passed in the 2019 Legislative Session would result in about a $120 million surplus for FY 2020-21, after adding to the budget reserve at the time of the November 2019 Forecast. The October Update suggests this number could go up, given the higher revenues coming in to date, or go down, because of anticipated slower economic growth in 2021.

One important way that policymakers can prepare in a time of increased uncertainty around the economy is by building a strong budget reserve. After years of sound fiscal policy, the state's budget reserve is at nearly $2.1 billion, and is just shy of the 4.9 percent of general fund revenues that MMB currently recommends. A robust budget reserve is a critical part of adequately preparing for the next economic downturn. In the same way a family saves to withstand an unexpected serious illness or job loss, Minnesota builds this reserve so that when a recession hits and state revenues plummet, the state can avoid drastic cuts in critical services and continue to serve Minnesotans’ needs as they strive to get through tough times. Last session, policymakers agreed to withdraw nearly $500 million from the reserve in FY 2022-23; they should take steps in the 2020 session to instead strengthen the budget reserve.

The next look at the state’s fiscal and economic health will come in early December with the release of the November Budget and Economic Forecast, which will give a full picture of state revenues, expenditures, and economic projections.