The Minnesota Budget Project staff is currently at a conference in Washington, D.C., but given our wonky personalities we just had to take a quick look at today’s state Budget and Economic Forecast. Here are our top five takeaways:

- The forecast projects a $678 million positive balance for FY 2016-17. This figure is for the remainder of the current budget cycle, which ends on June 30. And it is after one-third of the positive balance is transferred to strengthen the state’s budget reserve.

- The November forecast also projects positive balances in the future. Today’s report shows a $1.4 billion positive balance available for the upcoming FY 2018-19 biennium. This figure assumes that the balance for the current biennium will remain for use in FY 2018-19. This forecast also gives us our first glance at the FY 2020-21 biennium, in which the state has a projected $1.5 billion positive balance.

- But the future balances do not take into account what it takes to maintain current levels of service.When the impact of inflation on spending is included, the surplus morphs into a much smaller $73 million in FY 2018-19 and into a $1.7 billion deficit in FY 2020-21. This means that to the extent the surplus is used for additional spending or tax cuts, this will come at the expense of keeping up with current commitments.

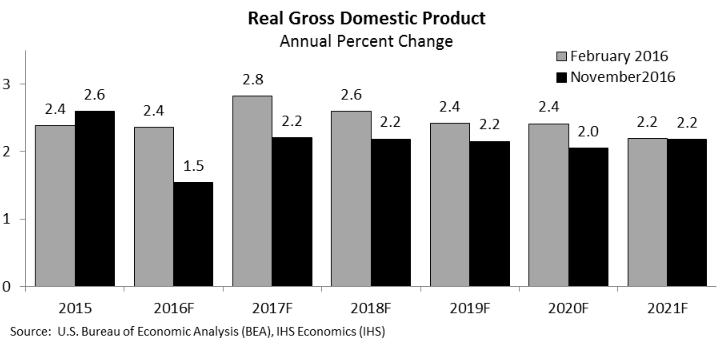

- The forecast expects weaker economic growth than projected earlier this year. The national economy is still expected to grow over the next several years, but now at a slower 1.5 percent in 2016 and hovering just above 2 percent yearly growth from 2017 through 2021.

- The forecasters are moderately confident in these projections, but there’s more uncertainty than usual. IHS Markit, Minnesota’s economic consulting firm, assigns a 65 percent probability to their baseline economic forecast, and a 20 percent probability to their more pessimistic scenario where political uncertainty both in the U.S. and abroad weakens the economy and leads to a short recession starting late next year. The forecasters assign a 15 percent probability to a more optimistic scenario where incomes, housing and consumer spending are boosted by higher productivity, which increases national economic growth next year.

In the upcoming 2017 Legislative Session, policymakers will put together a budget for the upcoming biennium. The November Economic Forecast gives Governor Mark Dayton the baseline information he needs to put together his proposed budget for the FY 2018-19 biennium that he will release in January.

As they make tax and budget decisions this session, policymakers should focus on state investments that expand economic security and enable our families, children and seniors to thrive. This includes affordable health care and child care, and targeted tax credits so that Minnesota workers can better support themselves and their families.

Now is not the time to turn our backs on the progress we’ve made for a more sustainable tax system that allows us to invest in our communities. Large and poorly targeted tax cuts don’t spur economic growth – that hasn’t worked out for states like Kansas.

We’ve long called on policymakers to make responsible tax decisions. Caution is more important than ever, given today’s modest long-term revenue numbers. Making large tax cuts now would make it harder to effectively respond to what’s ahead, including an uncertain economy and potential large-scale federal changes to tax policy and funding for states. Our own state history has shown that when taxes are cut too much in surplus years, it makes it more difficult for the state to respond to the needs of our residents in the next economic downturn. Instead, we should invest in a more durable prosperity that reaches all Minnesotans.

-Clark Biegler