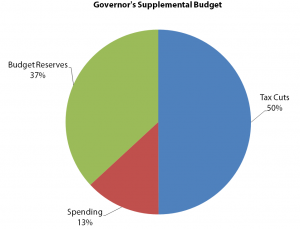

Governor Dayton today released the outline of his supplemental budget, which proposes $616 million in tax cuts, $455 million more for the state’s budget reserves and $162 million in new spending.

The supplemental budget describes the Governor’s proposed changes to the two-year state budget passed last year. We’re looking forward to seeing the details, but here’s our initial take: We applaud the continued focus on making the tax system work better for low- and moderate-income families, and attention to building more robust reserves. But our concerns include the size of the tax package, and we would like to see more of the surplus go to meet the needs of those Minnesotans who have not yet benefited from the economic recovery.

The supplemental budget describes the Governor’s proposed changes to the two-year state budget passed last year. We’re looking forward to seeing the details, but here’s our initial take: We applaud the continued focus on making the tax system work better for low- and moderate-income families, and attention to building more robust reserves. But our concerns include the size of the tax package, and we would like to see more of the surplus go to meet the needs of those Minnesotans who have not yet benefited from the economic recovery.

Taxes: The Governor’s tax proposal includes changes in a number of areas, including:

- Federal conformity items, including improving the Working Family Credit, addressing the ‘marriage penalty’ faced by non-itemizers and several other items.

- ‘B2B repeal,’ or the elimination of three business-related sales taxes. (The combination of income tax reductions through federal conformity and B2B repeal is similar to House File 1777, up for a vote in the House today.)

- Other tax reductions for middle-income Minnesotans, including an expansion of tax benefits related to child care that would benefit 170,000 Minnesota families.

- Tax reductions for businesses and investors, including a $15 million increase in the Angel Investor Tax Credit.

- Sales tax reductions for local governments that are working collaboratively.

- Eliminating the gift tax and cutting the estate tax.

We strongly support those components of the Governor’s tax package that make our tax system work better for low- and moderate-income Minnesotans, such as improving the Working Family Credit. Low- and moderate-income Minnesotans still pay a higher percentage of their incomes in state and local taxes than the highest-income Minnesotans.

However, one item of concern is the estate and gift tax component. We are pleased that Governor Dayton’s proposal to cut the estate tax is smaller than some other options put forward. But a closer look is needed at the long-term costs and the impact on the tax system, given that the estate tax is the most progressive component of the tax code.

Another concern is that the tax cutting proposal is too big. Recent history teaches us that when the state goes too far in tax cutting during the good times, it makes the bad times worse. It contributes to larger deficits when the next economic downturn comes, and makes it harder to meet the needs of struggling Minnesotans.

Reserves: The Governor’s recommendation to add $455 million to the budget reserves takes a big step toward building our ability to respond to the next economic downturn. Minnesota has filled the budget reserves to the level required by current law: $661 million in the budget reserve and $350 million in the cash flow account. However, Minnesota Management and Budget recommends that the state have $1.9 billion in its reserves. The Governor’s recommendation would bring the reserves and cash flow account to nearly $1.5 billion.

New spending: The Governor’s supplemental budget also funds a small number of what he terms “essential expenditures.” This includes additional funding for heating assistance, school lunches, and a rate increase for home and community based service providers. He also includes increases for the Department of Corrections, MnSCU, and the University of Minnesota. We appreciate that the supplemental budget includes some funding to meet the needs of Minnesotans struggling to make ends meet, and hope Governor Dayton will be open to other such proposals this session. For example, there are more than 8,000 Minnesota families on waiting lists for child care assistance – a crucial way to support parents in the workplace.

-Clark Biegler and Nan Madden