More than 240,000 Minnesota workers will have a harder time supporting their families if Congress doesn’t act to prevent key provisions of two federal tax credits from expiring. The Earned Income Tax Credit (EITC) and the Child Tax Credit (CTC) were improved thanks to legislation passed in 2008 and 2009, but these improvements are set to expire.

The EITC and CTC are only available to working people. The EITC is specifically structured to make work pay, boosting incomes so that working families are better able to make ends meet. The CTC is intended to help families with the costs of raising children, but it originally failed to reach families with lower incomes. Legislation passed by Congress in 2008 and 2009 improved the CTC. As a result, some low-income parents were able to claim the CTC for the first time, while others saw their credit increase. The 2009 legislation also improved the EITC by reducing marriage penalties and increasing the credit for larger families.

If these improvements are allowed to expire, 19 million workers around the country — and 242,000 in Minnesota — would see their incomes drop. A married couple with three kids earning $35,000 would lose roughly $1,200 if Congress fails to act on the EITC provisions. A single mom with two kids earning $14,500 would lose her family’s entire $1,725 Child Tax Credit.

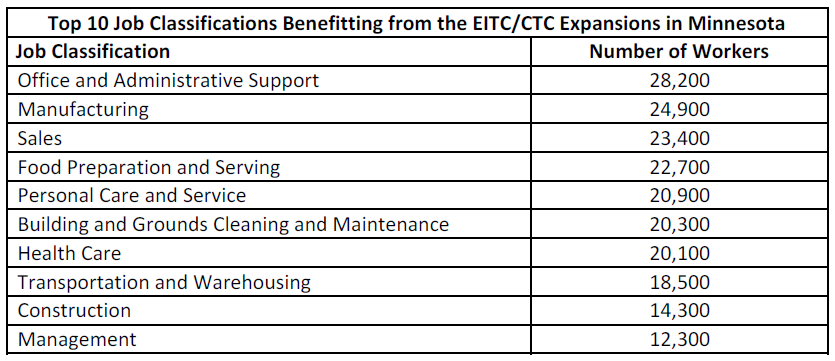

The Minnesotans who would be harmed if these tax provisions expire work in a diverse array of important jobs in emergency rooms, at factories and on construction sites across the state.

Source: Center for Budget and Policy Priorities

The expiration of the improvements would strike a major blow to two potent anti-poverty tools. If the EITC and CTC provisions expire, 16.4 million people around the nation, including 7.7 million children, would be pushed into or deeper into poverty.

The boost in families’ incomes from these tax credits has big benefits for children. Children in families that receive the EITC and the CTC do better and go further in school. Children who receive the EITC are healthier, and when they grow up, they earn more.

These credits have had a long history of bipartisan support. In the coming months, Congress will debate extending a number of tax benefits for businesses. When they do so, they should put working families at the top of their agenda and make sure that the improvements to the EITC and the CTC do not expire.

-Ben Horowitz